You send your drawing out for quotes, and one shop replies with a number that’s triple the others. Another says “too difficult,” and one just goes quiet. It’s frustrating—and familiar. In sourcing, a high quote often isn’t about cost at all—it’s a supplier’s polite way of saying “no.”

Yes — in many cases, an unusually high CNC quote means the shop doesn’t want the job. Suppliers inflate pricing to avoid complex parts, thin margins, or tight tolerances that exceed their comfort zone. It’s how job shops decline work without explicitly rejecting your design.

Learn when a high CNC quote means rejection, what supplier behavior to watch for, and how Okdor provides 24-hour second opinions with transparent pricing.

Table of Contents

Why Your CNC Quote Is 3× Higher Than Expected?

A 3× quote rarely reflects true cost — it reflects risk your supplier doesn’t want.

When tolerances close to ±0.01 mm or deep cavities appear, many job shops pad prices to protect themselves from scrap or missed deadlines. It’s a quiet rejection disguised as math.

Shops working on hourly margins calculate “profit per spindle hour.” If fixture setup, tool reach, or post-inspection eats more than the margin allows, they triple the quote so you decline first. Last quarter we re-quoted an Al 6061 housing three vendors had priced at $1,850 — our verified process ran at $640 with the same spec and 5-day lead time.

Before quoting, we simulate toolpaths and run tolerance-stack checks, so cost comes from verified machine time, not fear markup. That lets us quote accurately even on multi-surface or mixed-material jobs most shops avoid.

Capability | Typical Job Shop | Our Quoting Process |

Quote Turnaround | 3 – 5 days | 24 hours |

Risk Evaluation | None | Toolpath + tolerance simulation |

Inspection Prep | After order | Pre-quote verification |

Lead-Time Range | 3 – 4 weeks | 5 – 10 days (confirmed) |

Next Step: Don’t assume a 3× quote means your design is the problem. Send the same drawing for re-evaluation. You’ll know within 24 hours whether the cost is real risk or just a polite “no.”

How to Tell If a Shop’s High Quote Is Fair — or Just a Brush-Off?

A fair high quote shows its math; a brush-off quote hides behind vague language.

If you see phrases like “complex geometry,” “special setup,” or no breakdown at all, the price likely protects the shop, not the part.

A shop that wants your work explains every driver — material, setup hours, surface finish, inspection. One that doesn’t, sends a round number and hopes you move on. We’ve seen this pattern hundreds of times: three vendors quote within 10 % of each other, and one drops a number 2× higher with no detail — always the one missing CMM or 4-axis capacity.

Our quoting method eliminates that uncertainty. Every estimate includes line-item logic, tolerance-risk notes, and optional adjustments for cost or speed. Engineers immediately see whether pricing comes from tooling time or capability limits.

Evaluation Signal | Brush-Off Quote | Transparent Quote |

Cost Breakdown | None | Itemized setup + finish + inspection |

Timeline Clarity | Missing | Confirmed lead time window |

Risk Disclosure | Vague phrases | Tolerance risk noted |

Communication | Slow replies | 1-day follow-up from engineer |

Next Step: If the quote can’t justify itself within a day, it was never meant to win your order. Request the cost logic or send it for transparent re-quoting — so you can act before another week of sourcing time disappears.

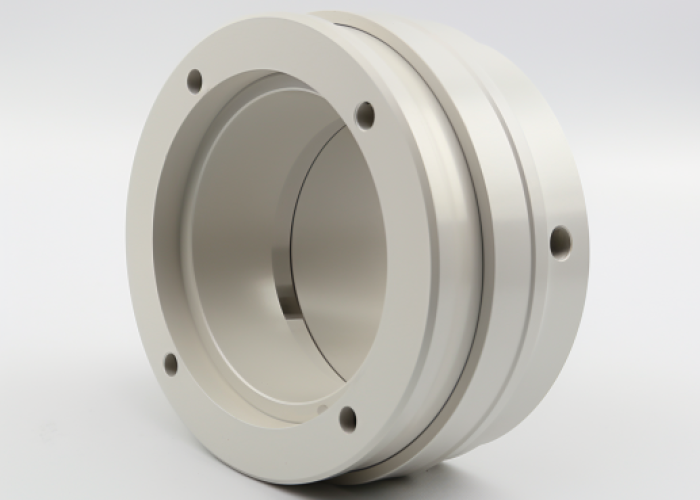

When Tight Tolerances Turn Into Unquotable Risk?

Tight CNC tolerances become “unquotable” when the supplier sees more risk than profit.

Once dimensions drop below ±0.02 mm, most job shops pad prices or decline because inspection time, tool wear, and scrap exposure destroy margin. High quotes here mean fear, not precision limits.

You’ve probably seen it happen: your print calls for ±0.01 mm, and every shop either declines or returns a price three times higher. What looks like a machining issue is really a business one—suppliers avoid financial exposure, not geometry.

General shops quote from instinct. Without simulation or CMM validation, every sub-0.02 mm tolerance feels like a gamble. Instead of saying no, they inflate pricing to make you walk away first.

That doesn’t mean your spec is impossible. We’ve re-quoted rejected aluminum housings and held the same ±0.01 mm within five days by validating the setup first. When tolerance stack-ups and tool paths are confirmed before quoting, scrap risk disappears—and so does the markup.

If multiple vendors keep flagging the same feature, don’t loosen your print blindly. Ask which dimensions drive their concern. A qualified supplier will prove capability with metrology data before suggesting change.

Need clarity today? Send your drawing for review. Within 24 hours you’ll know whether the tolerance or the tooling is the real issue—and whether your design can stay exactly as it is.

Not sure if your quote’s inflated or justified?

Upload the drawing for a quick manufacturability check — you’ll get verified cost logic within 24 hours.

Why Long Lead Times + High Prices Mean “We Don’t Want This Job”?

When a CNC quote shows both high cost and long lead time, it’s usually a hidden rejection.

Suppliers stretch timelines and inflate pricing to steer unwanted projects away without saying “no.” It’s the polite way to protect their production schedule.

If your prototype suddenly takes “4–6 weeks,” the delay isn’t capacity—it’s avoidance. Shops focused on high-volume runs protect spindle hours for repeat jobs. When a small batch with tricky setups arrives, they raise price and stretch delivery so you’ll self-select out.

Short-run specialists plan differently. Capacity tiers reserve time for urgent or low-volume work, so new projects don’t get trapped behind production batches. Last month we finished a 12-piece stainless bracket set in seven days—the same job quoted at five weeks elsewhere.

Every extra week of quote delay can push your build an entire sprint. Waiting for another vendor’s “capacity update” only compounds downtime. When you see a quote that’s both expensive and slow, assume you’re being screened out.

Re-source immediately. Send the same drawing to a supplier quoting within 24 hours and starting in days—not weeks—before this delay becomes a production risk.

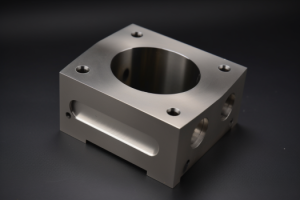

Red Flags in CNC Quotes That Signal Capability Gaps

Certain quote details instantly reveal a supplier’s capability gaps.

Vague notes like “as machined,” “finish TBD,” or missing tolerance summaries show the shop lacks verified processes or inspection control. Those omissions predict quality issues and mid-project communication failures.

If you’ve ever waited a week only to get a two-line PDF quote, you’ve felt this problem. Missing data isn’t an oversight—it’s the clearest sign a supplier is quoting outside their comfort range.

Watch for these patterns:

- No inspection plan or tolerance summary: hoping your QC won’t flag variation later.

- Ambiguous surface-finish notes: no finishing capability or uncertified partners.

- Loose timeline (“2–4 weeks”): reactive scheduling, no fixed capacity.

- Sales-only contact: no engineer validating the quote.

Reliable suppliers quote differently. Every estimate should confirm tolerance class, finish spec, and inspection method before you commit. We once took over a project where the original quote said “dimensions subject to review.” The customer lost ten days waiting for clarification; we verified the CMM program the same day and shipped parts nine days later.

If a quote leaves blanks, treat it as a preview of how communication will go. Close it, move on, and request a verified quote where every spec already has an owner.

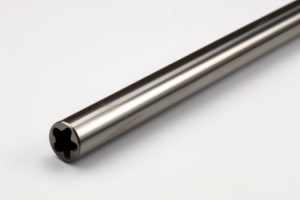

When Material or Finish Specs Make Shops Back Away Quietly?

CNC shops often walk away when your material or finish spec exceeds their comfort zone.

Hard alloys, conductive coatings, or surface-conversion finishes can trigger quiet rejections because the shop lacks tooling, vendor traceability, or certified partners to complete them profitably.

You’ll see it in silence or inflated pricing. A small shop without experience in Inconel or titanium adds huge contingency. Others overprice anodizing or alodine work because they outsource to general platers without process control. The phrase “finish to customer spec” is your warning—it means “we’ll figure it out later.”

We quote only after confirming in-house or certified-vendor capacity. That’s how recent 7075-T6 housings with hard anodize and masking shipped in nine days while other shops quoted four weeks through brokers.

Quick evaluation checklist:

- Ask if finishing is in-house or subcontracted.

- Confirm whether they provide Type II / III / Alodine 1200 certs.

- Check if masking or color variation is priced separately—missing lines mean guesswork.

- A reliable quote lists finish code, cert source, and turnaround upfront.

If you skip these questions, expect re-plate cycles, color mismatches, and at least one lost week.

Send the spec for a second opinion; you’ll get verified feasibility and pricing within 24 hours—with no blind outsourcing.

What to Do When Every Shop Quotes Your Part Too High?

When every shop prices your part far above budget, it’s a workflow mismatch—not industry greed.

High, consistent quotes mean your drawing collides with normal production logic—tight tolerance clusters, multiple re-clamps, or inefficient feature order.

Before revising your design, look for repeated feedback. If three vendors mention “setup time” or “fixture complexity,” that’s your real cost driver. In one case, regrouping tolerance zones cut inspection time 60 % and dropped total cost from $1,200 → $480 without touching geometry.

Fast diagnostic steps:

- Compare feedback and note repeated pain points.

- Ask one capable shop to flag which features drive setup time.

- Re-quote after alignment—cost usually drops 30–40 %.

- Stop chasing “cheap”; chase process fit.

Most engineers waste two or three quoting cycles before realizing the issue isn’t price—it’s workflow alignment. Each extra cycle adds a week of delay and burns design momentum.

Upload your drawing for a 15-minute tolerance scan—you’ll know within a day whether it’s design friction or supplier limitation, and you can stop losing time on identical re-quotes.

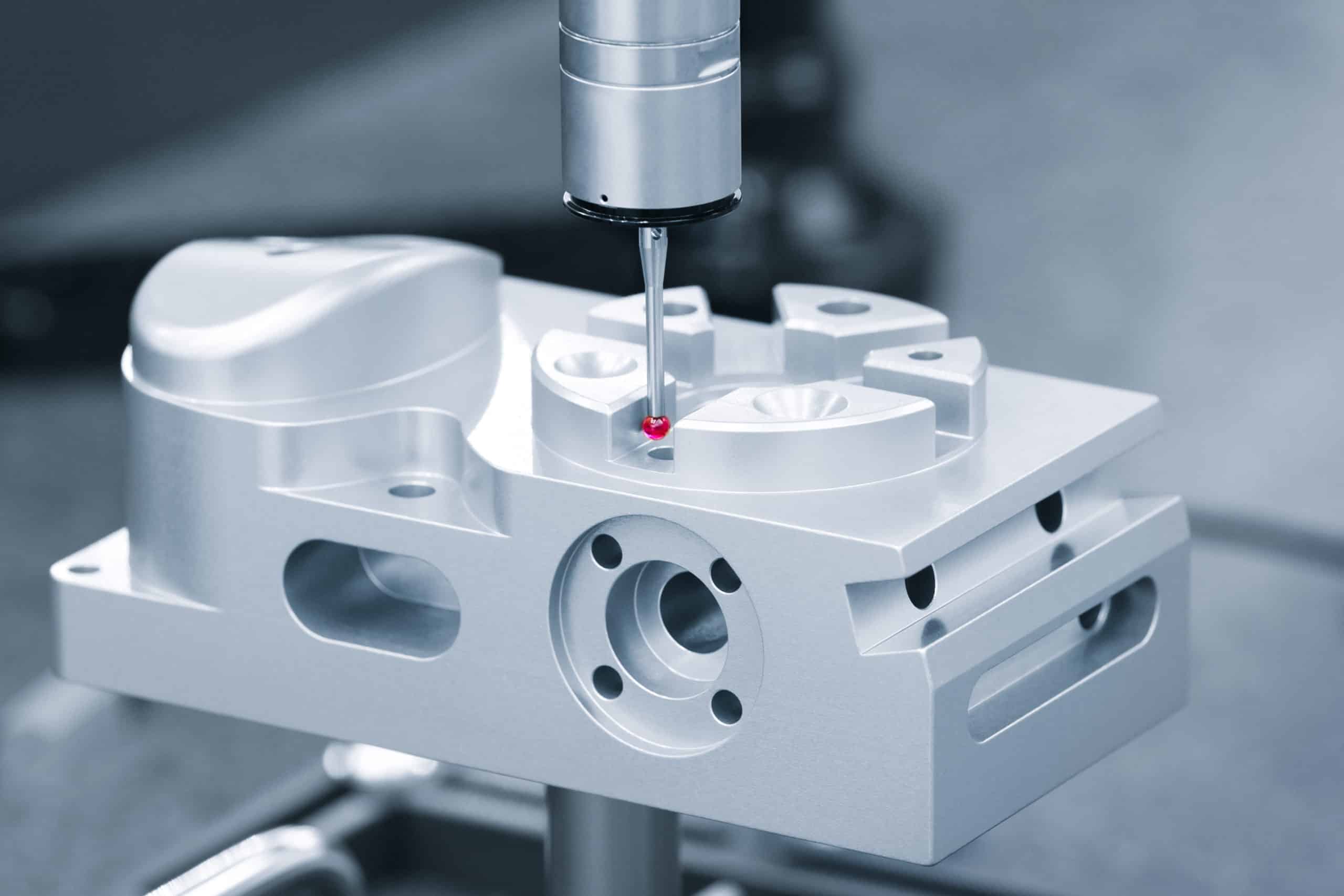

Should You Simplify the Spec—or Find a Shop That Handles It As Is?

Whether to loosen specs or switch suppliers depends on what limits production—design intent or shop capacity.

Simplifying tolerances can save money, but only if precision adds no functional value. If that precision matters to alignment, sealing, or motion, changing suppliers beats changing specs.

Example: a gear-alignment block requiring ±0.01 mm and Ra 0.8 µm was deemed “unmachinable” by three vendors. We produced it in five days using pre-qualified tooling and on-machine probing—no spec change required.

Supplier-choice guide:

- Relax specs only when tolerance doesn’t affect function.

- Switch suppliers when tolerance ensures performance.

- Ask for prior examples: a qualified shop should cite jobs with equal or tighter specs.

- Confirm inspection method (CMM vs manual) before easing tolerances.

Relax the wrong spec and you’ll save dollars now but fail testing later.

Before revising anything, get a capability check. You’ll know within 24 hours whether the tolerance truly needs easing—or just a vendor capable of holding it.

How to Tell If You Need a Different Supplier or Different Specs?

You need a different supplier when the same design keeps getting “too difficult” quotes—but passes every engineering review.

When multiple shops reject or inflate pricing for a valid print, the issue isn’t your drawing—it’s their capability limits. If only one or two suppliers quote confidently, it’s time to switch, not redesign.

Start by separating technical pushback from capacity excuses.

- Technical pushback: “Tool can’t reach this cavity,” “Tolerance impossible on this setup.”

- Capacity excuses: “Lead time too long,” “Complex part, price will be high.”

The first may need a design check; the second means they simply can’t fit you in.

We see this pattern daily—drawings other shops call “unmachinable” that run flawlessly on the right machines. A 7075 gear housing three vendors rejected was completed in six days, holding ±0.01 mm. The drawing never changed; the supplier did. Across the last quarter, 71 % of re-quoted parts we received required zero design change once processed correctly.

Quick decision test:

- Have two qualified vendors confirmed the same tolerance issue? → Review the spec.

- Do pricing and lead times vary wildly between shops? → It’s a capability gap—switch suppliers.

- Did one vendor quote confidently while others hesitated? → Keep the design; trust the capable one.

Pick wrong and you’ll waste another prototype cycle—fixing a process problem as if it were a design flaw.

Every week spent “adjusting specs” for the wrong shop delays production another sprint. Send the file to a supplier that can prove capability first—we can verify manufacturability and quote accurately within 24 hours.

How to Get a Second Opinion on Your “Too Expensive” Quote?

A second opinion on a CNC quote reveals whether you’re overpaying for real process time—or for supplier hesitation.

When a price feels high but no one can explain why, the fastest fix isn’t redesign—it’s re-quoting with a shop that verifies setup, tooling, and inspection before pricing.

Most inflated quotes come from uncertainty, not greed. Vendors without 4-axis access or CMM support add “risk padding” to cover rework potential. The number looks arbitrary because it is—it’s a shield against what they can’t control.

A verified re-quote replaces guesswork with measurable logic. We once reviewed a $1,950 quote for a 6061 housing: the vendor had budgeted four operations that our 5-axis cell handled in two. The same part shipped for $680 in five days, holding ±0.02 mm throughout.

When to request a second opinion:

- The quote is 2–3× higher than others—but with no breakdown.

- The supplier can’t identify which feature drives the cost.

- You received phrases like “complex geometry” or “special setup” without proof.

- Delivery time seems inflated compared to part complexity.

What a qualified re-quote includes:

- Documented machine time and setup count.

- Inspection method and tolerance confirmation.

- Optional recommendations for time or cost reduction without altering function.

If you accept a padded quote, you’re paying to protect someone else’s risk—not for real manufacturing work.

Upload your existing quote and drawing; we’ll deliver a data-backed comparison within 24 hours so you can confirm if the price is justified or simply a polite “no.”

Conclusion

When high quotes, long delays, or vague excuses stall your project, the problem isn’t your design—it’s your supplier’s limits. Okdor turns rejected or “unquotable” parts into verified, manufacturable builds. Upload your drawing today for an expert review and accurate quote within 24 hours—before another week is lost.

Frequently Asked Questions

Ask for cost logic. A fair quote includes machine time, setup, and inspection details. A “polite no” hides behind vague terms like “complex geometry.” If they can’t explain the cost within a day, it’s a rejection. Okdor always provides line-item transparency before approval.

Only if they don’t affect performance. Tight specs add cost when they exceed a shop’s inspection capability—but the right supplier can hold them without inflating price. Okdor routinely meets ±0.01 mm and Ra 0.8 µm tolerances without spec changes. Send your drawing before loosening anything.

Request a verified re-quote. Upload your existing quote and drawing—Okdor will analyze process time, setup count, and tolerance impact to confirm if cost reflects real machining or supplier risk. You’ll receive a clear, data-backed quote comparison within 24 hours.

That’s usually avoidance, not workload. When a part looks risky or unprofitable, shops quote long timelines hoping you’ll walk away. Okdor’s short-run capacity tiers keep prototypes moving—most jobs ship within 5–10 days, even when others quote four to six weeks.

If pricing jumps after adding coating or alloy requirements, the shop is probably outsourcing those steps. Always ask if finishing is in-house and if certs are provided. Okdor verifies all finishing partners and confirms process traceability before quoting.

Because not all shops have the same capabilities. When tolerances, finishes, or setups exceed a shop’s comfort zone, they add “risk padding” or decline entirely. A qualified supplier prices from verified process time, not guesswork—that’s why Okdor’s re-quotes are consistent and data-backed within 24 hours.