Your CNC order was scheduled, then progress slowed after a larger customer entered the picture. Updates continue, but nothing moves.

If a CNC supplier delays your order to prioritize a bigger customer, don’t wait on promises. Ask for concrete proof that production has restarted. If that proof isn’t available, you should prepare to re-source immediately to protect your delivery date.

Below, we show how to tell whether production is truly resuming or quietly abandoned — and how to decide, with evidence, when waiting still makes sense and when switching suppliers reduces risk.

Table of Contents

Why do CNC suppliers delay scheduled production for bigger customers?

When your CNC order is delayed after a larger customer enters the schedule, it’s usually because the supplier reallocates limited machine time to protect higher-risk revenue — not because there’s a technical problem with your part.

In real CNC shops, capacity isn’t reshuffled evenly. When a large or long-term customer suddenly demands machine time, smaller jobs are easier to pause because they carry less commercial risk. Internally, this often means your order is removed from active machine planning or never reaches setup in the first place. From the outside, the order still appears “in progress,” supported by explanations such as operator availability or machine adjustments.

The issue isn’t whether those explanations are true. It’s whether your job still owns any machine time at all. A job that hasn’t reached setup can be paused repeatedly without disrupting the shop’s workflow, which is why these delays often stretch far longer than expected.

Production takeaway

If your order never reached setup, it doesn’t truly exist on the production schedule. Waiting longer doesn’t protect your position — it increases the chance your job keeps getting pushed behind work that has already started.

What’s the fastest way to verify CNC production has actually started?

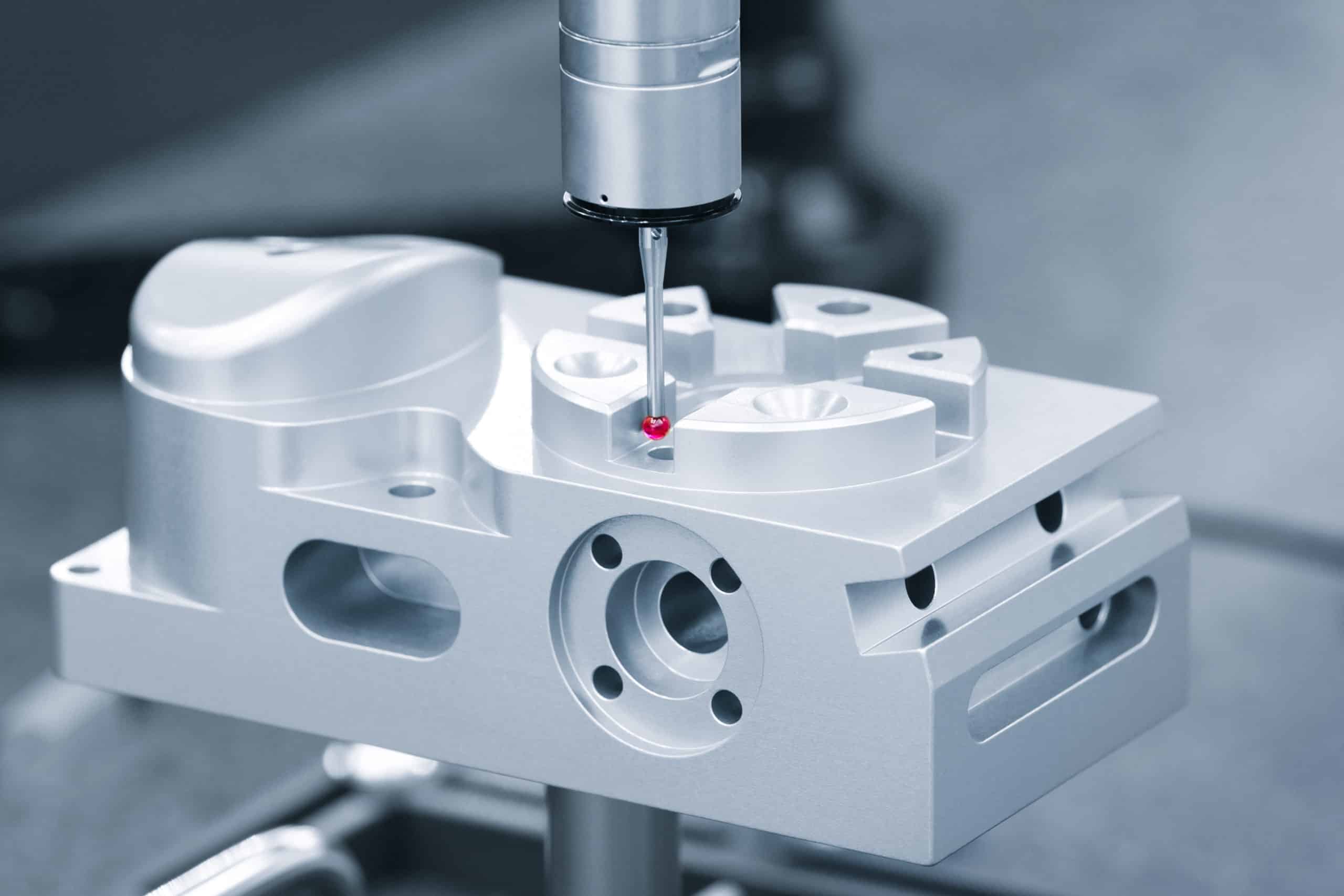

If your delivery date is slipping, the fastest way to verify your CNC order is truly in production is to confirm that irreversible shop-floor work has already been completed on your part.

Real production leaves physical evidence. Fixtures get installed, tools are mounted, CAM programs are locked, or first-article dimensions are measured against your drawing. These steps require real time and commitment, which is why they’re reliable indicators. By contrast, schedule updates or status emails can be issued without any machining having occurred.

At this stage, responsiveness can easily be mistaken for progress. A supplier may stay communicative while a job remains untouched. Once communication is separated from physical evidence, the situation becomes much easier to judge.

Production takeaway

Time without setup is not progress. If no setup or first-article evidence exists, your order can still be deprioritized at any moment — and delays usually compound from there.

What supplier responses signal your CNC order is unlikely to resume?

When updates keep coming but production never advances, certain supplier responses strongly indicate that your CNC order is unlikely to resume as planned.

Repeated timeline resets without new evidence are the clearest signal. If “next week” keeps moving forward with no mention of setup, machine assignment, or first-article progress, the job is no longer anchored to real production. Vague explanations — such as “internal coordination,” “priority adjustments,” or “waiting for the right window” — often appear when a job has already been removed from active scheduling.

Another warning sign is when questions about setup or machine allocation are answered indirectly. If direct questions are met with reassurance instead of specifics, it usually means there is nothing concrete to show. At that point, communication continues, but control over the schedule has already been lost.

Production takeaway

When updates stay polite but non-specific, the order is often being managed for expectation — not execution. Once clear production details stop appearing, the likelihood of a meaningful restart drops quickly.

What proof distinguishes a real production restart from supplier stalling?

If your supplier says production has restarted, the only reliable proof is evidence of work that would be costly or inconvenient to undo.

A real restart always leaves traces on the shop floor. Setup has been completed, fixtures or soft jaws are installed, tooling is mounted, or a first article has been measured against your drawing. These steps require time, operator commitment, and machine availability — which is why they don’t happen unless the job is genuinely moving forward.

By contrast, stalling usually comes with softer signals: updated schedules, verbal confirmations, or promises tied to future availability. None of these require the shop to commit resources. As long as your job hasn’t crossed into setup or first-article inspection, it can still be paused again with very little impact on the supplier’s workflow.

Production takeaway

A restart without setup or first-article evidence isn’t a restart — it’s a reset of expectations. Until irreversible work exists, the risk of another pause remains high.

How long should you wait before re-sourcing becomes necessary?

You should stop waiting once your CNC order has missed multiple restart points without showing new, verifiable production progress.

Waiting only makes sense when something concrete changes — setup completed, inspection records created, or material clearly being machined. When timelines keep moving but nothing irreversible has happened on the shop floor, each additional week increases risk rather than reducing it.

At that stage, experienced teams don’t usually wait for certainty. They quietly validate whether the part can be picked up elsewhere using the existing drawing and current status, so they understand their real options before the delay turns into a deadline failure.

Production takeaway

If nothing irreversible has happened since the last delay, more waiting doesn’t improve your odds — it simply reduces the number of recovery paths still available.

Not sure if waiting is helping or hurting?

Quick drawing and status review can clarify whether production is realistically resuming — or if time is already being lost.

When does waiting create more risk than switching CNC suppliers?

Waiting becomes riskier than switching when your delivery date is no longer protected by actual production progress.

Once an order has been deprioritized, continued waiting compounds downstream problems: missed assembly windows, idle inventory, compressed validation time, and rushed decisions later. Even if production eventually resumes, the margin for error shrinks with every lost week.

Switching suppliers isn’t risk-free, but the risk is visible and controllable. You can assess feasibility, lead time, and constraints upfront. Waiting, on the other hand, often feels safer precisely because nothing is being decided — until the delay becomes unrecoverable.

Production takeaway

When progress stops but the clock keeps moving, waiting feels passive but carries hidden cost. Switching early trades uncertainty for clarity — and that trade often favors control.

What’s realistic for recovering a paused order with another CNC supplier?

If your CNC order has been paused, recovery with another supplier is usually possible — but it’s rarely a simple continuation of where the last shop stopped.

In most cases, a new supplier must assume that no reliable setup exists, even if the previous shop claims progress. Tooling choices, CAM logic, fixture strategy, and inspection approach are often undocumented or incompatible across shops. That means recovery is less about “picking up mid-run” and more about re-establishing a clean, controlled starting point.

What is realistic is salvaging time by avoiding design rework and clarifying constraints early. If the drawing is complete, tolerances are understood, and material choices are clear, a capable shop can often compress the restart timeline by making deliberate process decisions instead of trial-and-error. What slows recovery most is uncertainty — not machining itself.

The mistake at this stage is expecting the new supplier to magically resume production without re-validation. That expectation usually leads to rushed assumptions, quality drift, or hidden delays later. A controlled restart may feel slower in the first week, but it protects delivery far better than trying to “save” time on paper.

Production takeaway

Recovery works when the restart is treated as a new, controlled launch — not an informal handoff. Assuming progress that can’t be verified usually costs more time than starting clean with clear process ownership.

What info enables a new CNC supplier to restart production fastest?

A new CNC supplier can restart production fastest when the drawing is complete and the current project status is clearly understood — not when partial promises from the previous shop are passed along.

The drawing is the anchor. Clear dimensions, tolerances, material specs, and surface requirements allow a new supplier to plan tooling, fixtures, and inspection without guesswork. Beyond that, knowing what hasn’t happened is often more valuable than knowing what supposedly has. Claims of “almost ready” or “about to start” don’t help unless they’re backed by setup or inspection records.

What actually accelerates restart is transparency: which processes were never completed, whether material was ever cut, and which constraints matter most to function. With that clarity, an experienced shop can decide quickly whether to reuse material, adjust sequencing, or recommend small process changes that reduce risk without touching the design.

At this stage, teams that recover fastest don’t wait to assemble a perfect package. They share the drawing and the real status as it stands, so feasibility and lead time can be judged honestly before more time slips away.

Production takeaway

Speed comes from clarity, not optimism. The faster a new supplier understands exactly where things stopped, the faster a realistic restart plan can be built.

See how fast this can realistically restart

Share the drawing and current project status to confirm recovery options before delays compound further.

What should you expect for cost and lead time in emergency CNC takeovers?

Emergency CNC takeovers almost always cost more and take longer than originally planned — but less than letting delays compound without control.

A new supplier must absorb setup effort, CAM work, fixture planning, and inspection preparation that may already have been “paid for” elsewhere but can’t be reused. That upfront work shows up as added cost or longer initial lead time. Expect that. It’s the price of regaining process ownership.

What’s often misunderstood is where the real savings come from. Emergency takeovers reduce risk by preventing downstream losses: missed assembly slots, expedited shipping, re-inspection, or last-minute design compromises. Those hidden costs usually exceed the premium paid for a controlled restart.

Lead time expectations also need adjustment. The first few days may feel slow because the new shop is validating assumptions rather than cutting metal immediately. Once that foundation is set, progress tends to be more predictable — and predictability is what protects delivery dates under pressure.

The most expensive outcome isn’t switching suppliers. It’s waiting too long, then switching anyway with no time left to recover properly.

Production takeaway

Emergency takeovers trade upfront cost for schedule control. Paying to regain clarity early is almost always cheaper than absorbing the downstream damage of prolonged uncertainty.

What warning signs predict a supplier will abandon your order mid-production?

A CNC supplier is likely to abandon your order when communication becomes less specific over time and concrete production details quietly disappear.

This usually doesn’t happen suddenly. Early updates mention machines, setups, or next steps. Later, replies sound friendly but vague — fewer dates, fewer names, fewer facts. When questions about setup, inspection, or machine allocation start getting indirect answers, it’s often because there’s nothing real to point to anymore.

Another sign is when reassurance replaces information. If updates focus more on goodwill — “we understand the urgency,” “please trust us,” “we’re doing our best” — while nothing physically changes on the shop floor, the job is no longer being driven by a schedule. At that point, your order exists more in email than in production.

Pay attention to ownership as well. When no one is clearly responsible for moving the job forward — no operator assigned, no planner named, no engineer following up — work tends to stall quietly. Orders don’t get abandoned in dramatic moments. They drift when nothing forces the next action.

The uncomfortable truth is that waiting longer rarely brings clarity back. It usually reduces your options.

Production takeaway

When specificity fades and reassurance takes its place, your order is already at risk. Recognizing that shift early gives you time to act while recovery is still possible.

Conclusion

When production stalls, waiting rarely restores control — clarity does. If your order is paused and decisions are getting harder, reviewing the drawing and current status with a capable shop can quickly show whether recovery is realistic, or if switching now protects your delivery.

Frequently Asked Questions

In many cases, yes. If the drawing is complete and functional requirements are clear, a new supplier can restart production without redesign. The key is verifying which constraints are critical and whether any undocumented assumptions were made by the previous shop.

Sometimes material or finished features can be reused, but setup, tooling strategy, and inspection planning are typically redone. Reuse is decided case by case after reviewing what was completed and how it aligns with the new supplier’s process.

Early confirmation of setup planning, inspection responsibility, and production ownership makes silent deprioritization far less likely. Establishing these checkpoints upfront protects schedules before delays begin.

The biggest risk is assuming undocumented progress can be trusted. Restart success depends on validating assumptions early rather than inheriting unknown setup or inspection decisions from the previous shop.

At minimum, the drawing, material specification, and current project status are enough to judge feasibility. Setup photos or inspection records help, but lack of handover data does not prevent a restart assessment.

A capable shop can usually confirm feasibility and outline a recovery approach shortly after reviewing the drawing and current status. Clear documentation speeds this up; missing or uncertain information is often clarified during the review.