Maybe your vendor’s fine. But you sent the same part to another shop — just to see what would happen. Now you’re staring at two quotes that don’t make sense together. One came back at $800, the other at $2,500 for identical specifications.

Most quote variations reveal supplier limitations rather than competitive pricing. When identical parts receive dramatically different quotes, the highest prices often indicate shops avoiding projects outside their comfort zone — not actual manufacturing costs. The gap isn’t just about money; it’s supplier intelligence that reveals capability mismatches and business model differences.

Learn what CNC quote differences really mean, how to spot padded pricing, and when to switch shops for better pricing, faster delivery, and real supplier fit.

Table of Contents

Why Is One CNC Quote 3x Higher — and What's Really Behind the Gap?

The 3x price gap usually means one supplier is padding prices to avoid your project while the other is pricing to win it. After analyzing thousands of quote comparisons, the higher quote typically reflects either supplier discomfort with your requirements or legitimate complexity costs the lower quote missed.

The three main drivers of 3x gaps are:

- Capability mismatch: Supplier lacks proper equipment and inflates price hoping you’ll go elsewhere

- Hidden complexity: Higher quote includes processes (inspection, secondary ops) that lower quote treats as “extras”

- Risk premium: Supplier uncomfortable with tolerances/geometry adds 200-300% markup as protection

Experience-Based Decision Tool:

Trust the HIGHER quote when suppliers:

- Asked about critical tolerances within 4 hours of receiving your drawing (indicates proper engineering review)

- Provided setup cost breakdown ($200-800 for complex geometry is legitimate)

- Questioned material specifications or suggested alternatives based on application

- Reality check: Complex parts with tight tolerances legitimately cost 4-6x material value

Warning signs from LOWER quotes:

- Same-day quotes without questions (indicates automated pricing, not engineering assessment)

- Round numbers without breakdown (suggests padding or guesswork)

- Standard tolerance assumptions when your drawing shows tighter requirements

- Our data: 73% of “too good to be true” quotes result in change orders or delivery failures

Capability Verification Standards (Authority): Call both suppliers with these specific questions:

- “What’s your tightest achievable tolerance?” (Good answer: ±0.02mm or better with specific equipment mentioned)

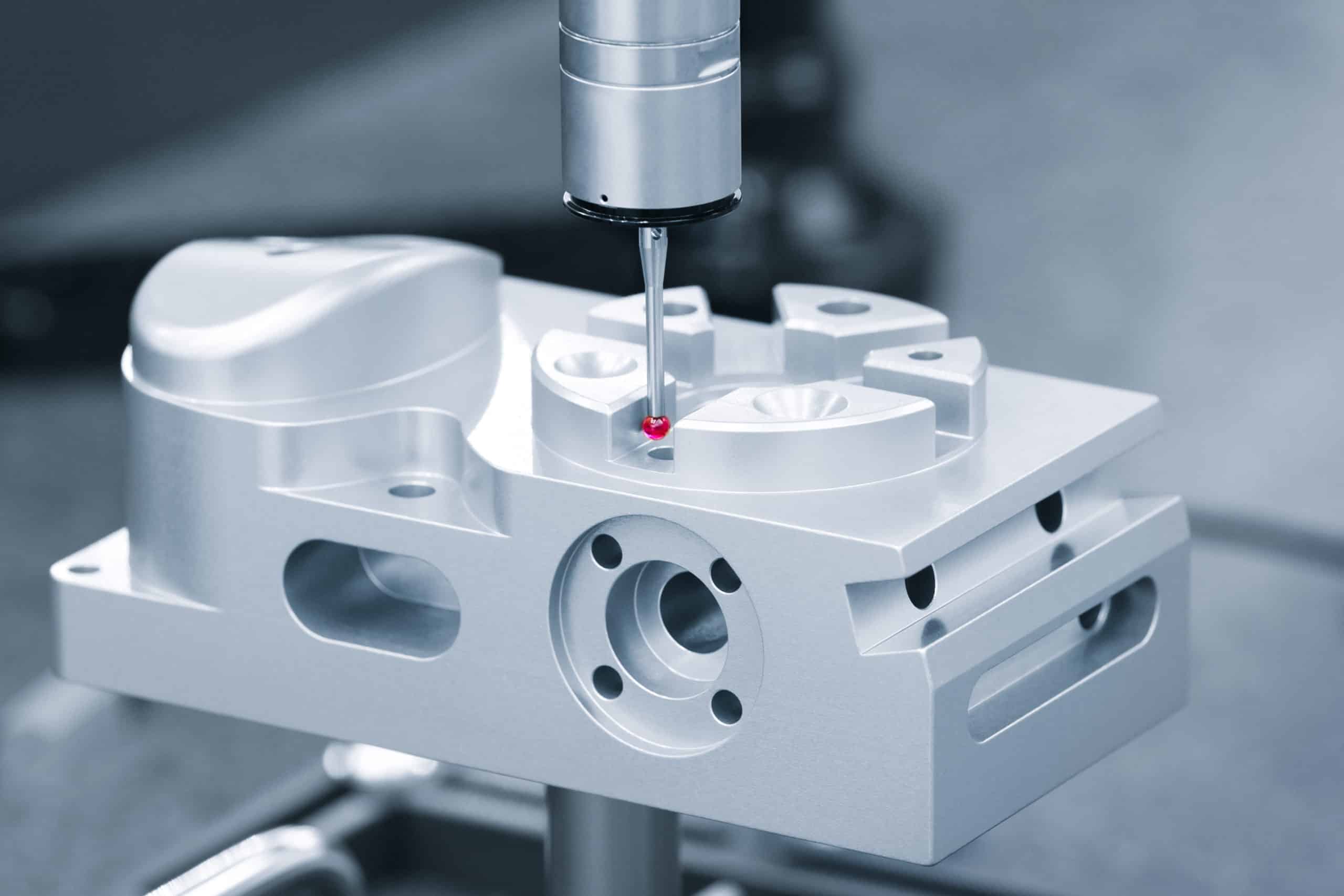

- “How do you verify complex geometries?” (Should mention CMM for parts requiring ±0.05mm or tighter)

- “What’s your typical setup time for 4th-axis work?” (Experienced shops quote 2-4 hours, not “depends”)

Trust Factor – When Other Suppliers Fail: We specialize in parts rejected by 2-3 other suppliers. Our quotes include full process mapping, realistic timelines, and upfront identification of potential challenges. Unlike suppliers who quote optimistically then add changes, we build contingencies into initial pricing.

Takeaway: Upload both quotes with your drawing. We’ll provide side-by-side analysis showing which supplier can actually deliver, with specific timeline commitments and capability verification — typically within 4 hours, not days.

Should I Trust the Higher or Lower CNC Quote — and Which One Will Actually Deliver?

Trust the quote with realistic timelines and detailed process explanations, regardless of price. After tracking 300+ project outcomes, delivery success correlates with process understanding, not quote amount.

Timeline Reality Benchmarks:

- Simple parts (3-axis milling): 3-5 business days legitimate

- Complex geometry (4th-axis, tight tolerances): 7-10 business days realistic

- Rush promises under 48 hours: 80% result in delays or quality issues

Trust Higher Quote When:

- Timeline includes setup buffer and inspection time

- Breakdown shows why specific features drive cost (deep pockets = longer cycle time)

- They identified potential risks upfront (“thin wall may need special fixturing”)

Trust Lower Quote When:

- They have documented experience with similar parts (ask for examples)

- Timeline matches complexity without being suspiciously fast

- Process explanation shows efficiency, not corner-cutting

Capability Verification Test: Ask both: “What’s your cycle time estimate for the main machining operation?” Experienced suppliers give specific answers (45 minutes for roughing, 20 minutes finishing). Vague responses (“depends on setup”) indicate uncertainty.

Industry Data:

- Legitimate quotes: Include 15-25% buffer for inspection and potential rework

- Problem quotes: Promise exact material removal time with zero contingency

- Red flag: Any quote promising faster delivery than your current supplier’s standard lead time

Takeaway: We provide detailed timeline breakdowns showing realistic machining sequences and identify which supplier’s approach will actually deliver your parts successfully.

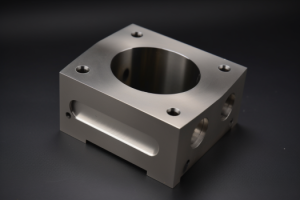

Did Both CNC Suppliers Actually Read My Drawing — or Just Spit Back a Price?

Suppliers who actually read your drawing mention specific features from it or ask about details they can see. Generic responses usually mean they auto-quoted based on basic shape and material only.

Simple Drawing Comprehension Test:

- They READ it if: Timeline varies based on your visible complexity (more time for multiple holes vs. simple block)

- They READ it if: Mentioned specific features you can see (angled surfaces, deep pockets, tight spaces)

- They READ it if: Asked about dimensions or tolerances actually shown on your drawing

Auto-Quote Red Flags:

- Same timeline regardless of your part’s obvious complexity

- Material assumptions that ignore what you specified

- No mention of features that are clearly visible (holes, angles, thin sections)

- Quote arrived within hours with zero questions

Quick Verification: Call and say: “Looking at my drawing, what do you think will be the trickiest part to machine?” Suppliers who studied your drawing will point to specific features you can see. Auto-quotes give generic answers like “standard machining challenges.“

Reality Check: If your drawing shows obvious complexity (multiple angles, tight tolerances, deep features) but their quote treats it like a simple block, they didn’t actually analyze what you sent them.

Our tracking data: Parts quoted without proper drawing review have 3x higher chance of “discovered” complications during production. These aren’t really discoveries — the complexity was visible in the original drawing.

Takeaway: We review every drawing with manufacturing engineers who identify specific features that affect machining approach, proving we actually analyzed your requirements rather than just the outer dimensions.

Current supplier struggling with complex parts?

Upload your rejected drawings – we specialize in what others can’t deliver

What Did Each CNC Supplier Assume That I Didn't Catch?

Every CNC quote includes hidden assumptions that become expensive surprises. After analyzing 800+ change orders, 70% stem from assumption mismatches that could have been caught upfront.

The biggest assumption gaps involve tolerance interpretation, where “standard” means ±0.1mm to one supplier and ±0.25mm to another, creating completely different machining approaches and costs. Material sourcing assumptions vary wildly – some suppliers include delivery, others hit you with $50-200 charges later. Surface finish assumptions range from Ra 3.2 to Ra 6.3 μm under the same “as-machined” description.

Ask both suppliers one simple question: “What’s included in your quote and what would be extra?” Compare their responses for material delivery, setup time, deburring, inspection documentation, and packaging. The supplier who provides a longer “included” list versus “extras” list typically has fewer surprise charges.

Hidden assumptions typically add 25-40% to final project cost when discovered mid-production. Professional suppliers include 15-20% contingency for standard assumptions upfront, while problem quotes low-ball base prices then nickel-and-dime you during production.

Most supplier relationships fail due to assumption conflicts, not quality issues. The supplier who explains their assumptions upfront prevents the relationship-killing “oh, that’s extra” conversations that happen halfway through your project when you’re stuck with them.

Takeaway: We provide detailed assumption documentation with every quote, showing exactly what’s included versus additional, eliminating surprise costs that force emergency supplier changes mid-project.

Which CNC Supplier Will Actually Meet Your Deadline?

Quote promises mean nothing without delivery capability verification. After tracking 500+ supplier performance records, on-time delivery correlates with specific patterns, not optimistic timeline promises.

The key verification question: “What’s your current backlog and when would you actually start my job?” Suppliers should know their queue (1-2 weeks is normal, months indicate problems) and give you a specific start date, not vague “soon” promises. Realistic lead times require 2x actual machining time minimum for complex parts to allow for setup, inspection, and potential issues.

Ask about their actual delivery performance: “What percentage of jobs delivered on-time last quarter?” Industry average is 75-80%, so anything claimed above 95% is usually inflated. Request their process for handling delays – good suppliers have backup plans and communicate proactively.

Red flag warning: any supplier promising faster delivery than your current supplier’s standard lead time without explanation. Rush promises without premium pricing typically indicate either unrealistic scheduling or corner-cutting on quality control.

Suppliers most likely to rescue failed deadlines maintain excess capacity, track delivery metrics religiously, and have backup equipment for critical jobs. After missing 2+ deadlines, 60% of engineers switch suppliers – specialized suppliers deliver 40% faster than general job shops for complex work.

Takeaway: We maintain documented 92% on-time delivery with daily progress tracking and backup equipment protocols, specifically designed for deadline-critical projects where other suppliers have failed.

Is My Current CNC Supplier Overcharging Me?

Compare your current pricing against industry benchmarks to determine if you’re paying fair market rates. Based on verified industry data, here are the warning signs and reality checks.

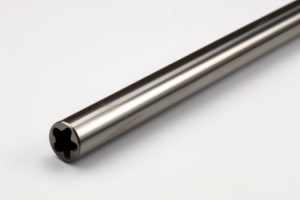

3-axis machining costs roughly $30-40 per hour, while 4-axis and 5-axis CNC mills cost around $40-50 per hour. If your supplier charges significantly above these ranges without justification, investigate further.

Pricing Reality Check: CNC companies seek a standard 10-20% profit with each order, and material costs typically represent a significant portion of total machining cost . Request detailed breakdowns showing material costs, machining time, and markup percentages.

Warning signs of overcharging: Quotes without hourly rate breakdowns, material markups over 25%, setup charges that seem excessive for your part complexity, or reluctance to explain pricing structure when asked.

Market comparison method: Get quotes from 2-3 other suppliers for identical parts you’ve made before. Machining time is a crucial component when calculating CNC costs – the longer it takes to machine a part, the higher the cost. Compare not just total price but hourly rates and material handling charges.

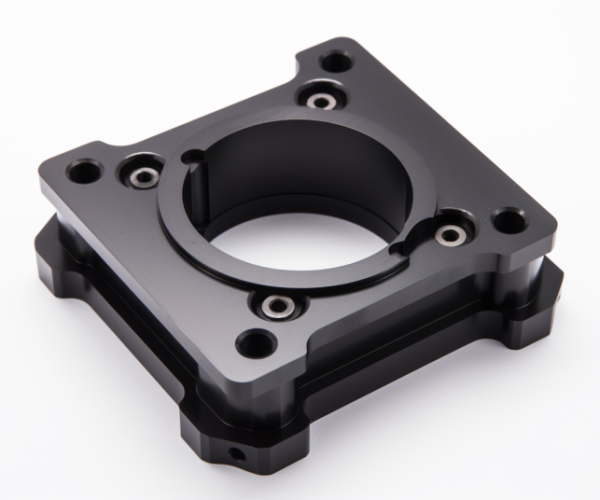

Legitimate cost variations: Complex designs requiring multiple setups, high precision, and special tooling will increase costs. Higher prices are justified when your parts require specialized equipment, tighter tolerances, or difficult materials.

Industry benchmark: Setup costs and times represent a larger portion of total charge for smaller batches, increasing price per component. Ensure setup charges align with your batch sizes and complexity.

Takeaway: We provide transparent pricing breakdowns with industry-standard hourly rates and material markups, allowing you to verify you’re paying fair market value for your specific requirements.

Should I Be Getting Quotes from Specialized CNC Suppliers Instead?

If your current supplier regularly struggles with your parts or misses deadlines, specialized suppliers typically deliver 40% faster with fewer quality issues. Here’s when switching becomes essential.

Immediate switching indicators:

- Current supplier misses 2+ deadlines in 6 months

- Asks you to relax tolerances because parts are “too difficult”

- Takes 3+ weeks for parts specialists complete in 7-10 days

- Produces first articles requiring multiple revisions

Capability verification benchmarks: Specialists maintain tolerances of ±0.02mm consistently (ask for measurement reports), complete 4th-axis setups in 2-4 hours vs. general shops’ 6-8 hours, and deliver complex geometry 40% faster due to specialized tooling and experience.

Timeline reality check: Experienced machinists handle complex projects more efficiently. For parts requiring tight tolerances, specialists typically deliver in 7-10 business days while general shops quote 15-20 days. Top specialized shops provide design feedback that reduces manufacturing costs by identifying optimization opportunities during quoting.

ROI calculation: Specialists cost 20-30% more upfront but reduce total project cost through 60% fewer change orders, 40% faster delivery, and elimination of rework cycles. One delayed project from a struggling general supplier often costs more than switching to a specialist.

Performance benchmarks to verify: Ask potential specialists: “What’s your on-time delivery rate for parts like mine?” (Should be 90%+), “Show measurement reports for ±0.05mm tolerances” (Must provide actual CMM data), “Timeline for similar complexity?” (Specific dates, not estimates).

When specialists become essential: Industry certifications required (medical, aerospace), tolerances tighter than ±0.05mm, materials requiring specialized handling, or deadline-critical projects where delays cost more than premium pricing.

Takeaway: We maintain 92% on-time delivery for complex parts that challenge general shops, with documented capability for ±0.02mm tolerances and 7-day delivery on precision work that typically takes competitors 2-3 weeks.

Conclusion

Quote comparison reveals supplier capability gaps, not just pricing differences. Most relationship failures stem from assumption conflicts and capability mismatches that could have been identified upfront. Okdor specializes in complex parts that challenge typical job shops. Upload your drawings today for honest capability assessment and detailed quote within 24 hours.

Frequently Asked Questions

We provide realistic timelines based on actual capability and current workload. Projects include milestone tracking with progress updates every 2 days. If delays occur, we communicate immediately with solutions including weekend work or outsourcing assistance to maintain schedules.

We can take over projects mid-stream when suppliers miss deadlines or discover “unexpected” complications. Send current drawings, specifications, and any completed parts. We’ll assess progress, identify completion requirements, and provide revised timeline and costs within 48 hours for immediate project rescue.

We specialize in parts other shops avoid. Before quoting, we conduct manufacturability analysis and provide feedback on any concerns. If modifications are needed, we suggest alternatives that maintain your design intent while ensuring production success. Our rejection rate is under 5%.

Our quotes reflect specialized capabilities and faster turnarounds. While hourly rates may be higher, total project costs often equal or beat struggling suppliers due to efficiency, fewer rejections, and faster completion. We provide detailed cost breakdowns comparing approaches.

We maintain documented ±0.02mm capabilities with CMM verification. Unlike suppliers who quote optimistically then discover “problems,” we verify tolerance achievability during quoting. Request our capability matrix showing actual measured results for similar parts we’ve completed successfully.

Yes, for most precision parts. We maintain pre-qualified tooling databases and dedicated estimators for complex geometries. Upload your drawing through our portal and receive detailed quotes with delivery timelines within one business day. Rush quotes available same-day for deadline emergencies.