Reducing inspections for “reliable” suppliers sounds efficient—but it’s rarely safe. Even trusted vendors change tools, operators, or setups without notice, and that’s when hidden defects start slipping through.

You should only reduce inspection after verifying process stability with real data—like Cpk trends, documented control plans, and consistent first-article results. Without those proofs, reliability is just assumption, not evidence.

This post explains how to judge supplier consistency, when reduced checks make sense, and what warning signs mean it’s time to resume full inspection—before it costs you $20 K in rework.

Table of Contents

How Many Good Batches Before You Can Reduce Inspection?

You can reduce inspection only after data—not intuition—proves your supplier’s process is statistically stable. A flawless delivery record looks convincing, but reliability built on anecdote collapses fast. We’ve seen Cpk drop from 1.6 to 0.9 in a single run after a new operator changed the tool offset by 0.02 mm. The first three years were fine; the fourth batch became a full recall.

Many suppliers rely on short-term “no defect” reports as proof of control, but those only measure results, not causes. A batch can pass because someone spent extra hours polishing burrs or adjusting feeds, not because the process itself is capable. Without capability data, offset tracking, and control chart trends, the next run could perform very differently—even under the same drawing.

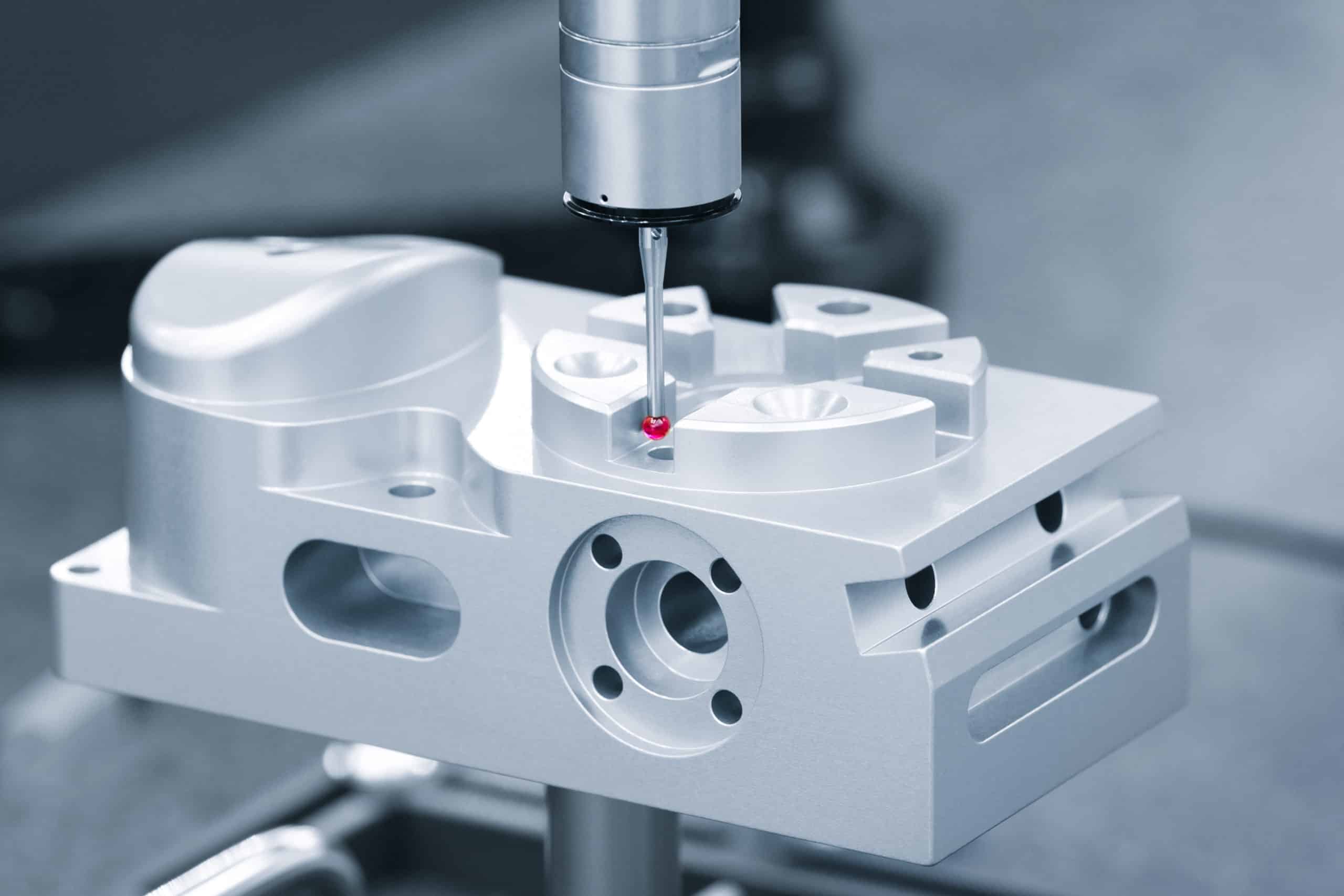

Our approach is to verify process behavior, not just final dimensions. That means trending key features across multiple runs, confirming gage R&R stability, and archiving reference first-articles for comparison. This evidence tells us whether repeatability is real or accidental.

Inspection Tip: Before reducing checks, ask your supplier for three consecutive capability summaries or Cpk trend charts for your key dimensions. If all you receive are “passed” reports, the process hasn’t been proven—it’s only been lucky. Keeping full inspection until proof exists prevents the quiet slide from stable to costly.

Why Three Perfect Batches Don’t Guarantee the Fourth?

Three perfect batches confirm only that those specific runs were well-controlled — not that the process remains locked. The moment a new tool, fixture, or subcontracted operation enters the mix, variation resets to zero knowledge. We once traced a 0.03 mm misalignment back to a supplier who changed a clamping jaw to “speed up changeovers” without re-validating setup.

Most job shops face constant pressure to stay efficient. Operators rotate, cutters are resharpened, and setups are shared across programs. None of these changes are malicious—they’re normal shop behavior. But without a documented control plan, every change quietly reopens the door for deviation. By the time a drift appears on your assembly line, the link to the root cause is long gone.

We manage this risk by freezing validated parameters between runs—same tool list, same fixture ID, same measurement references—and re-checking the first piece before restarting production. That’s how continuity replaces assumption.

Quality Insight: Before you relax inspection, confirm your supplier maintains version-controlled setup sheets and re-qualification steps after any tooling or process adjustment. If that documentation doesn’t exist, assume the fourth batch is a new process—and inspect it like one.

When Does Supplier Data Actually Justify Less Inspection?

Supplier data justifies reduced inspection only when it shows repeatable accuracy across multiple runs and unchanged process conditions. Clean reports from a few deliveries aren’t enough—they only prove parts passed, not why they did.

The real signal of reliability is trend stability. If dimensions hold steady over at least three consecutive production cycles—without operator or tooling changes—the supplier has demonstrated process control. Anything shorter is just a streak of good luck. Mature shops routinely review these trends every month to confirm their process still behaves the same.

We only consider reducing checks when we’ve seen stable variation over several months and can confirm identical setups, inspection methods, and environmental conditions. That’s what separates long-term consistency from short-term coincidence.

Inspection Tip: Ask your supplier for trend data covering at least the last three runs, reviewed by engineering—not production. If they can’t show how the process behaves over time, the inspection plan stays.

Switching Signal: When a supplier can’t provide this history, it’s not a “data gap”; it’s a control gap. Reliable partners make this transparency standard practice.

What Should You Ask Your Supplier Before Reducing Checks?

You should ask questions that confirm how your supplier controls setup, verifies process changes, and reviews inspection trends. If they can’t clearly explain these steps, the process isn’t ready for reduced checks.

These conversations expose whether their “reliability” is documented or just habit. Start with questions that reveal system maturity, not confidence levels:

- How do you confirm setups remain identical between batches?

- Who signs off first-piece verification before every restart?

- How often do you review inspection results for variation trends?

- What triggers a full re-check after tooling or operator changes?

If answers are vague or rely on “we always do it that way,” their control depends on memory, not method. Mature suppliers can show the procedures—often re-verifying within 24 hours of any change. That’s the mark of a stable process, not just a trusted team.

Quality Insight: The best question is simple—“Can you prove it?”

If the answer is words instead of records, keep full inspection active.

Switching Signal: When suppliers treat your questions as extra work, you’ve already learned enough—your project deserves a partner that sees these checks as standard, not optional.

Supplier reliability in question?

Upload your latest inspection reports for a fast capability review — get expert feedback and a revised quote within 24 hours.

What Should You Keep Inspecting No Matter What?

Some features stay on the inspection list forever—the ones where failure stops production, affects fit, or risks safety. These include tight fits, bearing seats, sealing surfaces, gear alignment, and precision bores.

Even with strong process control, small drifts accumulate. Tool wear, temperature, or fixture stress can shift a critical dimension by microns. Missing a single check on a load-bearing feature can shut down an entire assembly. That’s why smart teams reduce sampling elsewhere but never here.

We always recommend keeping 100 % inspection for functional and interface features, especially on the first part of every batch restart. Cosmetic or non-functional surfaces are fair candidates for sampling—but structural or mating geometry must stay verified every time.

Inspection Tip: Keep full inspection for any feature tied to fit, function, or safety. Sampling is for the rest.

Switching Signal: If your supplier pushes to drop checks on these features “to save time,” that’s not efficiency—it’s risk transfer. Reliable shops protect critical points even when no one’s watching.

How Reduced Inspection Saves $200 — Then Costs $20 K?

Reducing inspection saves money only when the process stays proven stable across multiple runs. When it isn’t, every skipped check becomes a potential recall. Cutting two inspection hours might save $200 this week—but one unchecked setup error can destroy $20 K of parts overnight.

We’ve seen this cycle repeatedly. A supplier drops sampling after several good lots; a new operator adjusts clamping, and suddenly tolerance margins collapse. The “savings” vanish under rework and missed-delivery penalties. Real efficiency means confirming stability—typically after at least three consecutive, unchanged runs with first-piece verification every 24 hours before volume restart.

Mature suppliers reduce checks gradually and pair each reduction with a re-qualification step. They know consistency must be re-proven, not assumed.

Inspection Tip: Save inspection cost after documented stability, not before.

Switching Signal: If your supplier suggests dropping inspection immediately after a few clean runs, they’re protecting margin, not reliability. A professional partner treats reduced checks as earned privilege—not default setting.

What Suppliers Don’t Tell You When They Change Something?

Suppliers often change things without notice—a new cutter, fixture, coolant, or subcontractor—believing it “won’t matter.” It always does. Even a minor tooling swap can shift critical geometry by 0.02 mm and compromise fit long before failure appears.

These unreported adjustments are common in job shops under schedule pressure. Because internal teams see them as routine, they rarely trigger re-inspection. When your sampling plan is already reduced, those silent variations go straight into assemblies.

Disciplined suppliers document every tooling or material change, notify customers within 12–24 hours, and run a fresh first-article before resuming production. That transparency separates process control from wishful thinking.

Quality Insight: Ask how your supplier communicates internal changes. If the answer is “we’ll tell you if it matters,” assume you won’t hear until it’s expensive.

Switching Signal: The best suppliers treat any process change like a drawing revision—logged, reviewed, and customer-approved before the next part ships. If yours doesn’t, it’s time to test one that does.

What Warning Signs Mean Resume Full Inspection Now?

Resume full inspection the moment communication slows or results drift toward limits. That’s your early warning that process control has slipped. Waiting for defects to appear turns prevention into damage control.

Watch for these triggers:

- Reports suddenly missing or showing borderline values.

- Small finish or color changes that weren’t approved.

- Unexplained questions about drawings previously understood.

- New operators, fixtures, or materials introduced quietly.

Any of these signs justify immediate 100 % inspection until stability is re-proven across at least two consecutive lots. Reliable partners will cooperate—they understand re-verification protects both sides.

Inspection Tip: When data or communication changes, treat it as a process restart and re-inspect right away. Two days of extra checks cost less than one customer complaint.

Switching Signal: If a supplier resists added verification when issues arise, it’s no longer risk management—it’s risk transfer. The moment you sense drift, reset or switch before your customer forces the decision.

Verbal Promise or Documented Quality Plan?

A supplier’s verbal promise means little without a written quality plan that defines how stability is measured, verified, and re-approved after changes. Words can’t be audited; procedures can.

Many small shops rely on informal habits: “We always check the first part.” But when operators rotate or schedules tighten, those habits vanish. A documented plan spells out inspection frequency, sign-off responsibility, and what happens when variation appears. Mature suppliers update this plan every 6–12 months—or immediately after tooling or process changes—to keep control continuous.

When such plans exist, inspection reduction becomes a controlled decision, not guesswork. You can trace who approved what, when, and why. That transparency shortens audits and lowers sourcing risk.

Quality Insight: Before approving reduced inspection, review your supplier’s written quality plan. If none exists, you’re trusting memory instead of measurement.

Switching Signal: If their only assurance is “we’ve got it handled,” they’re managing by confidence, not control. Reliable partners document what they promise—and prove they follow it.

Even with documentation in place, real reliability depends on how consistently that plan is executed on the shop floor—something only disciplined, specialized suppliers achieve.

How Do Specialized Suppliers Stay Consistent Without Oversight?

Specialized suppliers stay consistent because their process control runs on schedule, not supervision. They verify every critical feature on the first piece of each run, log inspection results automatically, and review trends weekly. By contrast, typical job shops only review quality data quarterly—or after a customer complaint.

This difference is why specialists maintain stable accuracy even when customers reduce inspection. Their processes don’t depend on reminders. Consistency is engineered into fixture calibration, setup validation, and feedback loops that detect drift before it reaches production.

General shops rely on people and memory; specialists rely on system discipline. That’s what keeps tolerances tight and repeatability unchanged over time.

Inspection Tip: The real proof of consistency is identical results months apart—without anyone chasing updates.

Switching Signal: If your supplier performs well only when you’re watching, that’s reactive control, not process maturity. It’s time to move to one that maintains standards automatically.

Conclusion

Reducing inspection too early turns reliability into risk. Many suppliers promise consistency but lack the proof to sustain it. Okdor verifies every process through documented control and repeatable accuracy—so reduced checks never compromise quality. Upload your drawings today for an immediate manufacturability review and 24-hour quote turnaround.

Frequently Asked Questions

We specialize in urgent recovery projects. Upload your drawings or inspection data, and our engineering team will assess manufacturability and quote within 24 hours. In most cases, replacement parts can be started within 48–72 hours, preventing costly production downtime.

Start gradually: cut sampling on one low-risk feature after multiple stable runs, then verify results over two follow-up batches. Treat it as a controlled test, not a permanent change. Professional suppliers will help plan and monitor this transition with full transparency.

You can only trust reports that include raw data and traceable measurement sources. Many suppliers summarize results without showing how readings were taken or who verified them. Ask for full inspection sheets and calibration records. If they hesitate, treat the data as incomplete and maintain your own checks.

Reliable shops recalibrate key gauges and CMMs every 6–12 months or sooner if they see drift. Always request recent calibration certificates tied to serial numbers. If your supplier can’t produce current documents, accuracy claims lose credibility—don’t reduce inspection until proof is shown.

Third-party audits are useful for initial qualification, but long-term stability depends on the supplier’s internal control system. Use external inspectors for verification during process changes or before major deliveries—never as a substitute for the supplier’s own accountability.

Look for inspection trend logs, setup verification sheets, and recorded tool-offset adjustments. These show control over time, not just pass/fail outcomes. If your supplier only sends “OK” results, they’re reporting outcomes, not process capability—keep full inspection until trend data exists.