You send one drawing to three shops and get $150, $260, and $400 quotes for the same part. Under deadline, that inconsistency blocks approvals and kills confidence.

CNC quotes vary because every shop prices its own risk, not your design. Setup time, tolerance control, and inspection capability drive the spread more than geometry itself.

Ahead, you’ll see what quote gaps really reveal about supplier fit—and how clear specs and capable partners keep pricing predictable.

Table of Contents

Why CNC Quotes Range from $150 to $400 for the Same Part?

CNC quotes vary because every shop prices its own risk, tooling setup, and inspection time—not the drawing itself.

If you’ve seen the same part quoted at $150, $260, and $400, you’re not imagining things. Each supplier runs a different calculation based on how much work your job adds to their day. A small shop may quote lean to keep spindles turning; another builds in hours for fixture prep, first-article checks, and potential rework.

You’re not chasing pennies—you just need predictable data to plan budgets and justify sourcing decisions. The problem is that each shop’s process maturity drives how precisely they can forecast cost. Teams with pre-qualified tooling and digital quoting estimate within minutes; others protect themselves with broad safety margins.

That gap in process confidence is what drives inconsistent pricing—not supplier dishonesty.

How to Move Forward

Before comparing totals, ask what each shop assumed for setups, cycle time, and inspection scope. If one counts three setups and another one, you’ve found the spread. Transparent assumptions turn “random” numbers into actionable insight and show which vendors will hold pricing steady after purchase order, not just during quoting.

What the Quote Spread Really Says About Supplier Fit?

A wide quote range reveals whether your part fits a supplier’s machines, tolerances, and workflow—not market volatility.

When a design lands squarely inside a shop’s comfort zone, pricing tightens fast. When it pushes their limits—thin walls, long tools, tight surface calls—they price defensively to cover uncertainty. The numbers aren’t arbitrary; they’re a map of capability alignment.

You’re not trying to prove who’s cheapest—you need to know who can deliver repeatable results without constant re-quotes. Low numbers can mean efficiency from familiar parts—or risky shortcuts on measurement. High numbers may mean the shop needs subcontracted inspection or extra setups to meet spec.

Think of the spread as a capability audit: narrow gaps indicate alignment; wide ones flag mismatch between your requirements and their process.

How to Move Forward

Track which suppliers stay within 10–15 % across revisions or material changes. Consistent pricing signals stable process control. Outliers—too high or suspiciously low—show where equipment, metrology, or experience no longer match your part. Those insights help you focus RFQs on partners built for your tolerance range and lead-time expectations.

Why One Shop Sees “Simple Part” and Another Sees “High-Risk Job”?

A part looks “simple” only until a shop measures its risk—tool reach, tolerance control, and setup repeatability define how safe the job feels.

Two suppliers can view the same 6061-T6 bracket completely differently: one calls it a one-hour job, the other quotes three hours plus fixture time. The gap reflects capability, not confusion.

Shops comfortable holding ±0.01 mm or better treat such parts as routine. Others lacking thermal control, probing systems, or stable fixturing see the same features as potential scrap. Once uncertainty rises above roughly 0.02 mm risk margin, the quote climbs fast.

If they can’t visualize consistent measurement, they price for failure—or decline to quote.

You’re not paying for geometry; you’re paying for a supplier’s confidence in repeating it.

How to Move Forward

Ask suppliers to identify which feature drives their risk factor. If they can explain it in numbers—“bore concentricity ±0.015 mm,” “depth-to-diameter ratio 6×”—they understand control.

If you hear vague terms like “too tight” or “tricky,” expect cost padding or delivery slips. Keep the suppliers who quantify risk; they’ll quote consistently and hold price once the PO lands.

Quotes all over the place?

Send us the drawings your current suppliers declined or overpriced—we’ll show the exact machining plan and stable cost before you commit.

How Vague Tolerances Push Every Shop to Quote Worst-Case Pricing?

When tolerances aren’t clear, every shop assumes the tightest possible spec—and prices as if ±0.01 mm applies everywhere.

A note like “unless otherwise specified” sounds harmless but forces machinists to cover unknowns. Each extra 0.01 mm of assumed precision adds setup minutes, inspection cycles, and tool wear risk. Multiply that by 40 features, and a $180 part easily becomes $300.

Ambiguity costs both sides: cautious suppliers slow quoting to re-check your print; rushed ones quote lean and gamble on rejection. Either way, you lose time.

Clarity lets them plan stable feeds, realistic tool offsets, and right-sized inspection—no hidden premiums.

How to Move Forward

Flag only critical features for tight control and define a general tolerance band (e.g., ISO 2768-m or ±0.1 mm) for the rest.

This single clarification can cut quote variation by 20 – 30 %.

When you revise prints, note any unchanged tolerances to prevent redundant re-quotes. Precision belongs where it matters—everywhere else should stay manufacturable and affordable.

What Quote Speed Actually Reveals About Shop Capability?

Quote response time mirrors process maturity—fast, detailed quotes mean organized systems; slow or vague replies often signal capacity gaps.

A supplier who returns pricing within 24 hours usually runs digital estimating tied to tool libraries and setup databases.

Delays beyond 72 hours mean manual quoting, overloaded schedulers, or uncertainty about holding tolerance.

Speed isn’t about eagerness—it’s about control. Shops with repeatable workflows don’t need long internal debates to price risk; they know their cycle times and margins precisely.

If you’re waiting a week for an estimate, the same delays will appear once production starts.

You’re not impatient—you’re reading a reliability metric in real time.

How to Move Forward

Track quote speed next to accuracy.

- < 24 h: mature process control, strong candidate for urgent work.

- 24–72 h: manual or overloaded, verify availability before PO.

> 96 h or no reply: unreliable for tight deadlines.

Quote speed is your first quality audit—if communication lags now, machining lead times will lag later.

When Detailed Specs Create Confusion Instead of Clarity?

Over-detailed drawings slow quoting and inflate prices because suppliers must verify every callout—even non-functional ones.

A part print loaded with dual units, duplicate finish notes, or thread details that don’t exist on the model can triple review time. One customer’s 316 SS housing jumped from $280 → $410 simply because five Ra 1.6 µm callouts were duplicated on cosmetic surfaces. Each unchecked dimension becomes perceived liability, so shops quote to the safest (and most expensive) interpretation.

Precision without hierarchy confuses quoting logic. When everything looks critical, suppliers assume maximum control—extra setups, slower feeds, full CMM inspection. That turns simple parts into “complex jobs,” delaying every approval cycle while cheaper, capable suppliers hesitate.

How to Move Forward

Simplify prints before sending RFQs:

- Flag only functional faces for Ra or GD&T.

- Define a general tolerance (e.g., ISO 2768-m = ±0.1 mm) for the rest.

Move references or secondary finishes to notes.

Streamlining often cuts quote-review time by ≈ 40 % and brings pricing within 10–15 % between suppliers. Each day saved at quoting is a day gained on prototype approval.

Why Some Suppliers Over-Quote Instead of Admitting Capability Limits?

Suppliers often double pricing rather than say “we can’t do it,” disguising capability gaps as “high-difficulty” jobs.

A local shop recently quoted $950 for a bracket other vendors priced at $480 ± 20 %. Their note—“deep-cavity setup requires special tooling”—was a polite rejection; they simply lacked 5-axis reach and didn’t want to refuse outright.

This behavior isn’t deception—it’s risk avoidance to protect reputation.

Over-quoting filters customers without confrontation. Clues include: prices 40 % + above average, vague terms like complex fixture requirement, and quote validity longer than 30 days. These aren’t negotiation signals—they’re warnings that capability doesn’t match spec.

How to Move Forward

If a quote exceeds others by > 40 %, request process detail: setup count, fixture type, or inspection method.

A competent shop will break down time honestly; an unsure one will stay vague. Choose transparency over hesitation. Each week lost to a politely inflated quote delays project launch far more than finding a capable replacement early.

How to Spot Suppliers That Quote Consistently—Not Randomly?

Reliable suppliers quote within ± 15 % across revisions because their pricing is data-driven, not guesswork.

They track real machine hours, cutter wear, and inspection time, so material changes shift cost predictably. One of our aerospace customers compared four aluminum housing quotes over three iterations: the consistent shop varied only 11 %, the rest swung up to 42 %—a clear sign of manual estimation.

Inconsistent quoting stems from memory-based pricing and fluctuating workload. Today’s “cheap” quote often becomes tomorrow’s missed delivery. Predictability in price usually means predictability in production.

How to Move Forward

Record each vendor’s pricing spread over several RFQs:

- ≤ 15 %: stable process—ideal for repeat work.

- 15–30 %: acceptable; confirm material or tolerance changes.

- > 30 %: unreliable—expect quality or schedule drift.

Consistent pricing reflects control, documentation, and capacity planning. Every time you choose the steady bidder, you reduce sourcing noise and keep your builds on track—no re-quotes, no deadline slip.

What to Do When Your Current Shop Can’t Explain Quote Differences?

When a supplier can’t explain why their quote suddenly doubled, it’s rarely the drawing—it’s uncertainty.

We see it often: round numbers, no breakdowns, vague phrases like “complex geometry.”

That kind of response means the estimate was built on instinct, not data.

Our quoting process works differently. Each estimate begins with recorded cycle-time data, tooling libraries, and inspection metrics from similar parts. Every dollar ties back to something measurable—setup, machining time, or inspection scope.

That’s why we can walk customers through each figure—two setups, ninety-minute cycle, one hour of QA—without guesswork.

One customer shared a housing quoted between $240 and $410 by three shops.

Our analysis showed it required just 85 minutes of spindle time and simple fixturing; the stable price was $265, and it held through production because every variable was modeled in advance.

If a supplier can’t justify its math within 24 hours, that’s a red flag.

Every hour spent decoding vague answers is a day lost on schedule.

We price from data, not hunches—so our quotes hold, and our delivery dates stay where they were promised.

How to Structure Prints That Get Comparable CNC Quotes?

Price consistency starts with consistent information.

If one drawing lists 6061-T6 aluminum while another leaves alloy unspecified—or if one view calls for Ra 1.6 µm and another omits finish—each shop fills the blanks differently.

That’s how identical parts return quotes from $260 to $390: one priced for hard-coat anodizing, another for raw metal.

Before sending RFQs, we normalize every print we receive—one tolerance block (ISO 2768-m ± 0.1 mm), unified callouts, paired STEP + PDF files, clear material specs.

This removes ambiguity before pricing begins.

Once the data is aligned, quote spreads typically shrink from ≈ 40 % to under 15 %, because suppliers are finally reacting to the same inputs.

A robotics customer once told us that after we clarified a single missing surface symbol, five suppliers returned prices within ten percent of each other.

The drawing hadn’t changed—clarity had.

Ambiguity inflates cost; structure controls it.

By standardizing every variable early, quoting becomes a true capability check, not a guessing contest.

Clean data equals predictable cost—and predictable schedules.

Should You Re-Quote with Clearer Specs—or Switch Suppliers Now?

Engineers often get trapped in endless re-quote cycles.

The drawing improves, but prices still drift, and delivery keeps slipping.

Re-quoting once can correct confusion; repeating it usually confirms a capacity gap.

Our estimating system links directly to real setup and cycle-time data, so updated quotes issue within 24 hours of clarified inputs.

When another shop needs a week, it’s not caution—it’s congestion.

Each quote loop adds two to three business days, delaying prototype approval.

A tooling buyer recently faced three weeks of quote delays for a precision insert.

We reviewed the same file, confirmed reach limits, and issued a fixed quote in one day—recovering nearly a week of lost schedule.

Here’s the rule we follow internally: two clarification rounds maximum before escalation.

If a supplier still hesitates after clear data, capability—not communication—is the problem.

Switching at that moment protects budget and momentum far more than another “updated estimate.”

Re-quote when communication failed. Switch when capability failed.

That’s how projects stay on track from first drawing to final inspection.

Conclusion

Inconsistent quotes signal supplier uncertainty, not design flaws. Our engineering team eliminates that guesswork with data-driven quoting that stays stable through production. Don’t wait for another vague estimate—upload your rejected drawings today for an immediate assessment and a verified quote within 24 hours.

Frequently Asked Questions

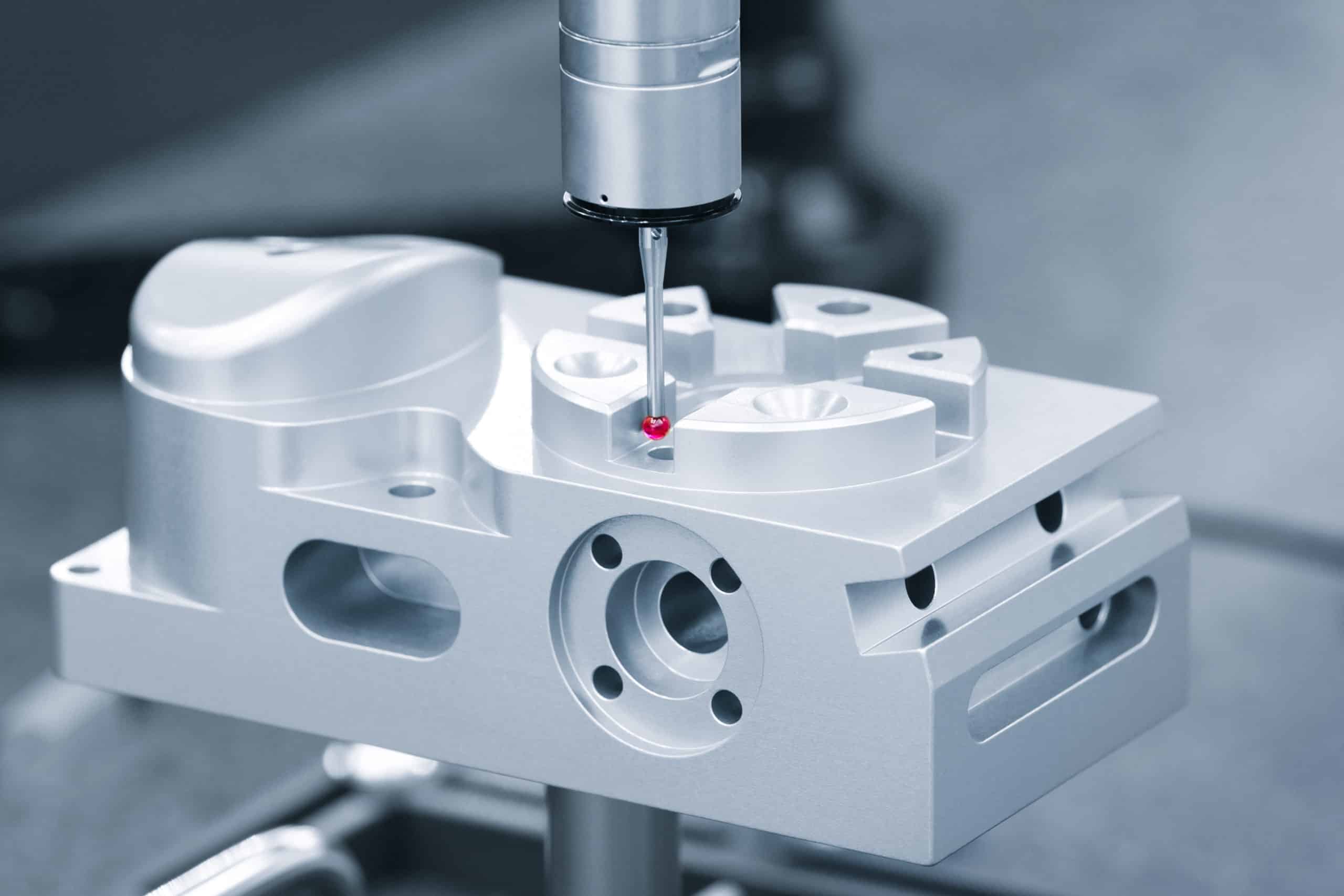

Every batch ships with full inspection data, including CMM reports, material certificates, and surface-finish verification when applicable. You receive photos and measured dimensions before dispatch, ensuring the delivered parts match the quoted quality exactly.

For prototypes, machining typically begins within 48 hours of PO and material confirmation. Multi-part orders start as soon as raw stock and tooling are allocated. You’ll receive a confirmed spindle-start date in the same email as your quote acceptance.

We accept partial or marked-up prints. Our engineers rebuild missing tolerance zones from 3D models and return updated manufacturable drawings within 12–24 hours. You’ll know exactly what changed before any chips are cut.

Yes. We offer independent dimensional inspection within 1–2 days using calibrated CMM and surface-finish measurement. You’ll receive a traceable report identifying pass/fail features so you can decide whether to re-machine or proceed to assembly.

We don’t reject the RFQ. Our process engineers flag the issue, annotate the affected features, and send recommended fixes—often the same day. You get a revised, manufacturable design and an updated quote without restarting the review cycle.

Yes. We re-measure a sample or drawing and replicate its fit within ±0.01 mm using our in-house CMM. When parts come half-finished, we verify geometry before cutting, ensuring continuity in assembly without restarting design validation.