Your supplier just sent a quote that’s double what you paid last time — for the exact same part. Same drawing, same specs, same material. You’re staring at numbers that don’t make sense, wondering if there’s a mistake or if you’re being taken advantage of. This isn’t just frustrating; it’s a crisis when you’re under deadline pressure and budget constraints.

Yes, you should switch suppliers when quotes double without justification. A 100% price increase on identical parts typically indicates the supplier either doesn’t want your business, has serious capacity issues, or is exploiting your relationship. Legitimate cost increases rarely exceed 15-25% year over year, even with material fluctuations.

Find out why CNC quotes spike on repeat orders, when switching suppliers makes sense, and how to do it without risking delays or quality drops.

Table of Contents

Why Did My Supplier Double My Quote Overnight?

Most quote doubles happen because your supplier’s business situation changed, not because your part got harder to make. Legitimate cost increases run 15-25% annually due to material fluctuations. Increases of 50-80% signal business changes like new ownership or capacity constraints. When quotes double (100%+ increase), your supplier either doesn’t want your work or thinks you’re locked in.

Call them out immediately: ask for a detailed cost breakdown showing exactly what changed. Legitimate suppliers provide line-item explanations (material +12%, setup +30% due to new equipment). Problem suppliers give vague responses or refuse to justify the increase.

The pattern is predictable: suppliers who suddenly double quotes are dealing with business problems like new ownership prioritizing high-volume work, key machinists leaving, or cash flow issues requiring immediate higher margins. Most shops hope you’ll either pay the inflated price or disappear quietly rather than explain their real situation.

Look for suppliers who maintain consistent pricing and provide transparent cost breakdowns. When shops double quotes on familiar parts, it usually indicates they lack efficient processes or simply don’t want that type of work anymore.

Next Steps: Demand a detailed cost breakdown from your current supplier within 48 hours. If they refuse or provide vague explanations, start getting alternative quotes immediately to verify realistic market pricing.

Why Do CNC Quotes Vary So Much Between Shops?

CNC quotes vary 200-400% between shops because you’re comparing specialists against generalists. Shops that handle your part type regularly quote aggressively. General job shops add massive margins for unfamiliar work, hoping to either profit heavily or price you out. Understanding which category your suppliers fall into explains everything.

Key differences that drive pricing: Setup efficiency (specialists complete in 2 hours what generalists need 8+ hours for), operator experience (specialists avoid costly mistakes and rework), and business focus (some shops want your work, others see it as risky distraction). Parts that are routine for experienced shops become expensive and time-consuming elsewhere.

Use quote patterns to evaluate suppliers: Extremely high quotes signal inexperience or disinterest. Extremely low quotes often mean underbidding with change orders coming later. The sweet spot is detailed quotes from experienced suppliers who understand your parts and price realistically.

Specialist shops typically quote in the lower-middle range because they have efficient processes. Generalist shops either decline complex work, quote extremely high, or lowball with hidden costs.

Next Steps: Get quotes from both specialists and generalists in your part type. Compare their explanations and pricing logic. Specialists provide detailed breakdowns and reasonable rates, while generalists often show reluctance or inflated pricing.

How Do I Know If My Supplier Is Ripping Me Off?

Warning signs include: refusing cost breakdowns, quote increases without clear justification, and treating standard requests as “special” work requiring premium pricing. Honest suppliers explain their numbers immediately. Problem suppliers hope you won’t question inflated margins or seek alternatives.

Test them with these questions: “What’s your hourly machining rate?” “How much setup time does this actually require?” “What are the current material costs?” Legitimate shops answer directly with specific numbers. Overcharging suppliers give vague responses, claim “proprietary pricing,” or deflect with technical jargon.

Common overcharging tactics include: Material markups 50-80% above market rates, inflated setup times (claiming 6 hours for 2-hour jobs), and “engineering fees” for routine programming that qualified shops include in base pricing. The telltale sign: suppliers who quote high then negotiate down when pressed, proving the original quote was padded.

Industry benchmarks for comparison: Standard setup rarely exceeds 2-4 hours unless truly complex. Material should be market rate plus 15-25% handling markup, not double market price.

Next Steps: Request specific hourly rates, setup time estimates, and material costs with current pricing. If they refuse detailed breakdowns or their numbers seem inflated, get competing quotes within 48 hours to establish fair market rates.

Quote Doubled? Get Second Opinion in 24 Hours

Upload your drawing now for honest comparison pricing. We specialize in parts other shops reject or inflate.

Is an 80% Price Jump on the Same Part Normal?

No, 80% price jumps are not normal for identical parts. Legitimate annual increases rarely exceed 15-25% even with material fluctuations. When suppliers hit you with 50-80% increases on unchanged specifications, they’re either experiencing serious business problems or deliberately pricing you out.

Here’s exactly what to do in the next 48 hours: Call your supplier immediately and say: “This quote is 80% higher for identical specs. I need a detailed breakdown showing what changed, or I’m sourcing alternatives.” Don’t negotiate yet – just demand justification. Their response tells you everything.

If they provide vague answers, deflect, or refuse breakdowns – start switching immediately. Suppliers who can’t justify dramatic increases are usually pricing you out and hoping you’ll pay rather than switch. This pattern repeats across the industry when shops either don’t want certain work or think customers won’t question inflated pricing.

If they provide detailed explanations, verify them against market data. Material costs, labor rates, and overhead changes should be documentable. Claims like “market conditions” or “new pricing structure” without specifics are red flags indicating they’re making excuses rather than providing real justifications.

Next Steps: Give your supplier 24 hours to justify the 80% increase with detailed cost breakdown. If explanations feel weak or they refuse to provide specifics, start getting alternative quotes immediately to establish realistic market pricing.

Can I Negotiate Down a CNC Quote That Seems Inflated?

Only if you have competing quotes and limited time. Don’t negotiate blind – suppliers who inflate pricing often expect pushback and price accordingly. Get 2-3 alternative quotes first, then decide if negotiation is worth the time risk.

Use this negotiation script: “I have competitive quotes 40% lower for identical specs. Your pricing needs to be within 15% of market rate, or I’m switching suppliers today. Can you match competitive pricing?” This forces immediate decision – no drawn-out negotiations that eat your timeline.

Set a 24-hour deadline for their response. Suppliers who want your business will respond quickly. Those who don’t will stall or provide minimal reductions. Engineers often waste weeks trying to negotiate with unreasonable suppliers while deadlines approach, then end up switching anyway under pressure.

Red flags that negotiation won’t work: Vague responses about “value-added services,” refusing to match competitive pricing, or requesting “more time to review.” These indicate they’re not serious about keeping your business at fair rates.

Next Steps: Only negotiate with competing quotes in hand and strict deadlines. Get alternative pricing first – having realistic market rates gives you negotiation leverage or switching options if your current supplier won’t be reasonable.

Should I Switch Suppliers Over a Doubled Quote?

Yes, switch immediately when suppliers double quotes without clear justification. A 100% increase on identical specs signals they either don’t want your business or think you’re locked in. Don’t reward this behavior – it only gets worse over time.

Calculate the real switching cost versus staying. Factor in timeline delays, qualification requirements, and potential quality issues. Most engineers overestimate switching risks while underestimating the cost of staying with unreliable suppliers who will continue exploiting the relationship.

Minimize switching risks with these protections: Get detailed quotes with firm delivery commitments, request first article inspection before full production, and maintain backup supplier options during transition. Experienced suppliers understand switching anxiety and provide clear timelines and quality checkpoints.

The biggest switching mistake is waiting too long. Engineers who negotiate with unreasonable suppliers often waste 2-3 weeks, then switch anyway under extreme deadline pressure. Starting the switching process early gives you more options and reduces crisis decision-making.

Next Steps: If your supplier doubled quotes without solid justification, start the switching process immediately. Get alternative quotes and timelines so you can make informed decisions rather than panic choices under deadline pressure.

How Fast Can I Actually Switch to a New CNC Shop?

For most precision parts: 1-2 weeks total switching time. This includes quote review (1-2 days), purchase order processing (1-2 days), and production start (3-5 days). Complex parts requiring special tooling may need 2-3 weeks. Emergency situations can often be accelerated.

Common switching delays and how to avoid them: File compatibility issues (send native CAD + PDF), material sourcing delays (approve alternatives upfront), inspection requirements confusion (prioritize critical dimensions). Look for suppliers who assign dedicated project managers for transitions rather than treating switches as routine orders.

Protect yourself during switching: Negotiate firm delivery dates with penalty clauses, require progress updates every 2 days, and maintain communication with your problem supplier as backup until first articles are approved. Experienced suppliers understand switching anxiety and provide regular updates with clear milestone tracking.

What can go wrong: file transfer errors, material delays, first article failures, communication gaps. The best switching suppliers anticipate these issues and have established protocols for handling transitions from failed suppliers. Ask potential suppliers about their switching process and risk management procedures.

Next Steps: Switching takes 1-2 weeks with proper planning and risk management. Contact potential suppliers early to get specific switching timelines and contingency plans, especially if your deadline is critical. Don’t wait until the last minute to explore alternatives.

How Do I Find a Reliable Supplier When Mine Failed Me?

When your supplier just failed you, speed matters more than perfect evaluation. Focus on suppliers who can start immediately and have proven track records with similar parts. Look for shops that maintain capacity for emergency work and don’t require lengthy qualification processes.

Emergency supplier evaluation checklist: Can they quote within 24-48 hours? Do they have current capacity for your timeline? Can they provide references from recent similar projects? Will they commit to firm delivery dates with penalties? These four questions eliminate most unreliable options quickly.

Fast-track your supplier search: Contact 3-4 specialists in your part type simultaneously, explain your timeline crisis, and request emergency quotes with delivery commitments. Reliable suppliers respond quickly with specific timelines and ask detailed technical questions. Problem suppliers give vague responses or can’t accommodate urgent needs.

Critical switching timeline: Initial contact and quote requests (Day 1), quote review and supplier selection (Day 2-3), purchase order and file transfer (Day 4-5), production start (Day 6-7). Okdor specializes in emergency supplier transitions and can begin production within one week for most precision parts, including gears that other shops reject or delay.

Next Steps: Don’t spend weeks evaluating suppliers when you’re in crisis mode. Contact emergency-capable suppliers immediately, get firm commitments within 48 hours, and start production with the most responsive option that demonstrates competence.

Conclusion

Supplier quote doubles signal they don’t want your business or think you’re locked in. Okdor specializes in parts other shops reject or inflate, providing honest pricing without the markup games. Upload your drawing today for immediate assessment and realistic quote within 24 hours – no supplier switching delays.

Frequently Asked Questions

We maintain transparent, consistent pricing with detailed cost breakdowns. Our quotes include material costs, setup time, and machining hours – no hidden markups or surprise increases. We’ve held pricing steady for 90% of repeat customers over 2+ years because gear specialization keeps our costs predictable.

We specialize in complex parts other shops avoid. Before quoting, we conduct manufacturability review and provide specific feedback on any concerns. If modifications are needed, we suggest alternatives that maintain design intent while ensuring production success – no blanket rejections.

We provide realistic delivery commitments based on actual capacity, not optimistic estimates. Projects include milestone tracking with progress updates every 2 days. If unforeseen delays occur, we communicate immediately and cover expediting costs including weekend work or outsourcing assistance.

Our pricing reflects specialized capabilities but often equals or beats job shops due to efficiency gains. We provide detailed cost comparisons showing where savings come from: reduced setup time, fewer rejections, faster completion. Most customers see 10-30% total project savings despite higher hourly rates.

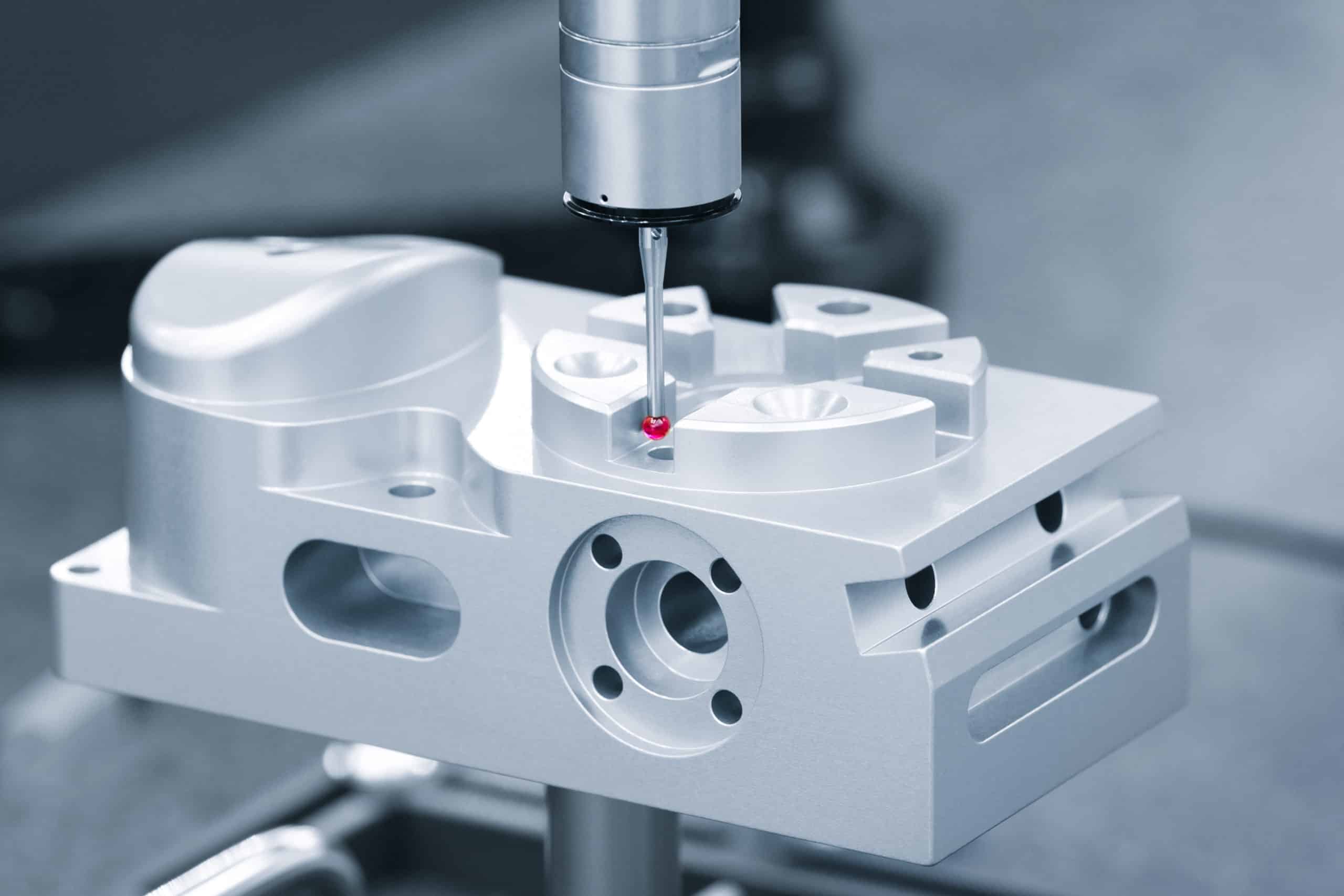

No extended qualification required for most precision parts. We can work from your existing drawings and specifications immediately. First article inspection typically completed within 48 hours of production start. Full qualification documentation provided after successful first article approval if needed.

Yes, we can begin production within 5-7 days for most precision parts. We maintain capacity specifically for emergency supplier transitions and have expedited file review processes. If your deadline is critical, we can often arrange weekend work to compress timelines further.