Most CNC suppliers go silent after you send a PO because they’ve hit a capacity or cash-flow wall they don’t want to admit. When production lines are overloaded, materials delayed, or payments stretched, some shops freeze communication rather than risk confrontation. Instead of updates, you get silence—and no visibility into whether your parts are even started.

CNC suppliers often go silent after you send a PO because they hit internal overload or disruption: production capacity maxes out, staff changes occur, or materials run short. As work piles up, communication becomes the first casualty.

Learn what supplier silence means, when to act fast, and how to recover lost time with backup quotes, capacity checks, and Okdor’s 24-hour re-quote support.

Table of Contents

What Happens When a CNC Supplier Goes Silent After You Send a PO?

When a CNC supplier goes silent after you send a PO, it’s rarely about bad manners—it’s a signal of a production jam. Silence begins when capacity runs out or tooling prep slips behind schedule. Once a job misses its planned slot, updates stop because no one can confirm a new completion date.

That gap quickly compounds. A three-day silence often means your job has already lost its machine slot; a week of silence can add two to three weeks to total lead time as tooling and inspection need to be re-queued. In some shops, this silence hides subcontracting or resource juggling—delays that keep growing while you wait.

Experienced suppliers prevent this through milestone-based tracking and visible progress checkpoints. Each phase—material allocation, setup, inspection—is confirmed in writing before cutting begins. If your current vendor cannot provide these milestones up front, expect the same silence later.

Sourcing Insight:

If a confirmed PO goes unanswered for three business days, assume schedule drift and act. One week of silence can inflate project cost by 10–15 % through missed slots and re-setup losses. Follow up once; if no clear timeline follows, request a secondary quote from a supplier that provides documented progress visibility within 24 hours.

Why Do CNC Shops Stop Responding Once They Receive Your Order?

CNC shops often stop responding post-PO because internal overload collapses their communication loop. When managers juggle too many jobs, production firefighting overtakes updates. Emails pause not from neglect but from system failure—most tracking depends on one coordinator or spreadsheet.

Once that link breaks, every open PO enters a blind zone. If deposits from newer orders are funding earlier ones, material buys stall and communication freezes. Each silent week can add 10–20 % to total project delay, especially when re-scheduling or re-inspection becomes necessary.

Well-structured suppliers prevent this by decoupling communication from individuals. Every order connects to shared milestones—machining, inspection, packaging—so updates flow automatically even when staff or priorities change. If a shop cannot provide that visibility before you issue a PO, that’s the early sign their workflow lacks control.

Procurement Tip:

When replies vanish, don’t wait for excuses—ask for specific checkpoints: next machining date, current inspection stage, expected shipment window. Reliable suppliers can produce this data within hours. Those who can’t are likely operating beyond capacity—and switching early protects both your timeline and budget.

Do Some CNC Suppliers Outsource Your Parts Without Telling You?

Yes—and it happens more often than most engineers realize. When capacity or tooling limits hit, many CNC shops quietly subcontract your parts to keep the PO “alive.” It avoids admitting delay but transfers risk you never agreed to. Once that hand-off occurs, you lose control of machining quality, tolerances, and delivery sequence.

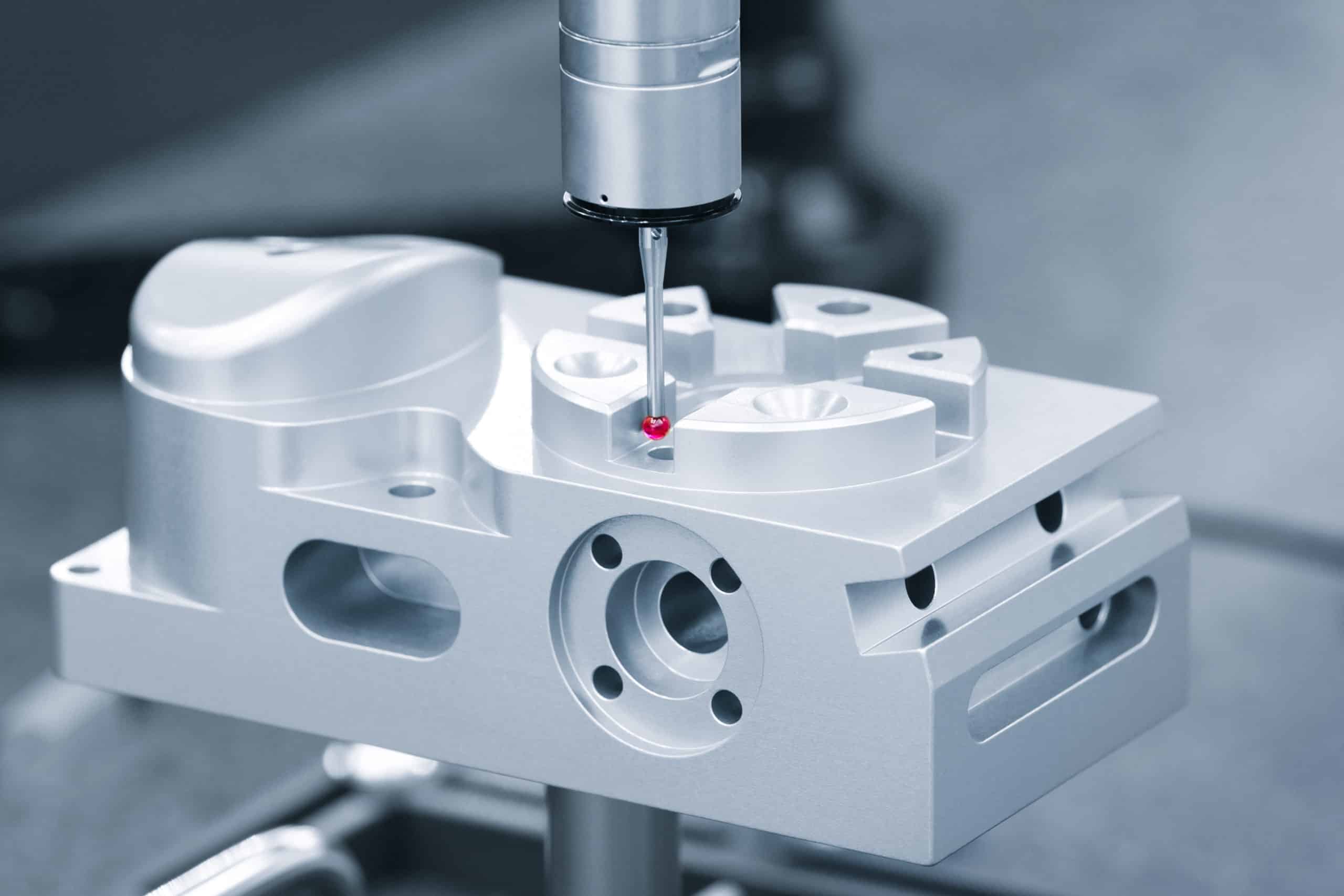

Undeclared outsourcing causes two hidden costs. First, dimensional variation—different machines, fixtures, and calibration systems create small but critical deviations. Second, traceability loss—material batches, certificates, or surface treatments may no longer match your specification. If issues appear during assembly, tracing accountability becomes nearly impossible.

Transparent suppliers disclose outsourcing before cutting begins and use audited partners with aligned QC standards. Ask early: “Will any operations be subcontracted, and how are they verified?” If the answer is vague, that’s your warning sign.

Sourcing Insight:

When email responses start shifting to new contacts or drawings are re-requested mid-build, assume subcontracting has begun. Each transfer can add 5–10 days to lead time and raise re-inspection costs by 10 % or more. Request in-process photos or inspection reports before further payment—responsible suppliers provide them without hesitation.

Tired of unanswered emails while your deadline slips?

Get your drawing re-evaluated by a responsive machining team that confirms capacity before quoting.

Should You Get a Backup Quote While Waiting on a Silent Supplier?

Yes—because silence past a few days signals risk, not patience. A backup quote isn’t confrontation; it’s insurance. Once your PO goes unacknowledged beyond 72 hours, the original supplier’s slot control has already weakened. Waiting longer only compounds cost once recovery machining or expedited shipping becomes necessary.

Many engineers hesitate, fearing to strain relationships. In practice, professional buyers run parallel quotes as standard risk management once uncertainty exceeds three business days. Preparing a secondary quote gives leverage and restores timeline control.

To make comparison useful, submit identical drawings and specs to both vendors and request milestone-based lead times, not vague delivery promises. The shop that specifies setup, machining, and inspection checkpoints usually has actual capacity; the one quoting a flat number rarely does.

Procurement Tip:

If no confirmation or progress appears within 72 hours of PO acceptance, launch a secondary quote before the week ends. A timely backup supplier can recover the schedule with minimal friction and often save 10–15 % in total delay costs. Once silence passes a full week, even the best quote becomes a recovery plan, not prevention—so act early.

How Long Before a Silent Supplier Becomes a Real Problem?

A silent supplier becomes a real problem sooner than most teams expect. Within 48 hours of a PO, you should have confirmation of material order and setup schedule. By day 3, missing updates mean workflow drift. After seven days, assume the job has lost its machine slot—and every day after can add exponential delay.

A two-week communication gap typically indicates tooling reassignment or subcontracting. When production finally restarts, expect 20–30 % longer total lead time and higher cost from re-setup or expedited shipping. That’s why proactive status checks are not micromanagement—they’re project protection.

Reliable suppliers maintain milestone-linked updates for material receipt, first-article inspection, and machining start. If your vendor cannot provide these checkpoints, silence isn’t temporary—it’s structural.

Sourcing Insight:

Treat three business days of silence as an early-warning stage and seven as the red line. Each lost week can inflate total project cost by 10–15 % due to missed slots and emergency logistics. Securing a verified backup quote before the second week keeps delivery—and your reputation—under control.

Can You Switch CNC Suppliers After Sending a PO?

Yes—switching suppliers mid-project is possible, but the longer you wait, the harder it becomes. Once production stalls for more than a week without updates, you’re already losing machine time and material allocation. The key is to act before the supplier actually starts machining or orders proprietary tooling.

If no confirmation of material purchase or tool list appears within the first five business days, you can usually withdraw without penalty. After tooling or partial machining begins, cancellation means you’ll pay for work in progress—but that cost is still cheaper than a full missed delivery.

Capable suppliers can take over unfinished projects by referencing your original drawings, setup notes, and quality requirements. Many can also provide status photos or part verification reports during the handover, giving visibility while production restarts. With a clean data transfer, machining can resume within 48 hours, often recovering two to three weeks of lost schedule.

Sourcing Insight:

If silence exceeds a week and you have no proof of material order, switching is safer than waiting. Share your drawings, PO, and any prior correspondence with a new vendor. Reliable shops can confirm manufacturability and timeline recovery within one business day—ensuring you don’t lose control of cost or delivery.

What’s Needed to Get an Emergency Quote from a New Supplier?

Speed depends on information quality. The reason many “emergency quotes” still take days is incomplete data—missing tolerances, unclear quantities, or absent material specs. A new supplier can only react fast when every technical and administrative detail is ready at hand.

To secure a true 24-hour turnaround, prepare a complete drawing package: 2D PDF with tolerances, STEP or IGES model, material, surface finish, and expected quantity. Include the prior supplier’s quote or PO date if available; it helps the new vendor gauge urgency and tooling reuse potential.

Also clarify delivery target and inspection needs upfront. Precise requirements prevent re-estimation cycles that waste hours. Organized buyers who send a single, consolidated file set often receive verified quotes within 12–24 hours, compared with several days when data arrives piecemeal.

Procurement Tip:

Before sending a new RFQ, spend ten minutes checking that all files and specs mirror the latest revision you plan to produce. Every missing note can add a full day to quote turnaround. Structured inputs equal structured response—and are the fastest path out of supplier silence.

How Do You Verify a New CNC Supplier Won’t Go Silent?

Preventing silence starts before the quote, not after the PO. Reliable communication habits are visible from the first contact. Suppliers that respond within 24 hours to inquiries, provide milestone-based schedules, and share real machining photos or inspection templates rarely disappear mid-project.

The biggest warning sign is generic quoting with no timeline detail. When a shop can’t specify setup start, first-article inspection, or shipment checkpoints, it means they quote from capacity guesswork—exactly how silence starts later.

Ask specific verification questions:

- Who manages project updates—engineer or sales rep?

- How often will progress reports be sent?

- What QC documentation accompanies each stage?

Clear, confident answers mean controlled workflow; vague ones mean risk. A supplier that maintains a 24-hour reply rhythm during quoting almost always sustains that same discipline during production.

Sourcing Insight:

Before approving a new supplier, test responsiveness: send one follow-up question and time the reply. Consistent answers within 24–48 hours confirm communication control. Anything slower under low pressure will only worsen during manufacturing—choose transparency over promises every time.

What Should You Do If Your Supplier Finally Responds After Days of Silence?

When a silent supplier finally replies, don’t rush to restart—pause and assess what changed. A late response often signals internal disruption: tooling just freed up, management intervened, or a backlog cleared temporarily. Accepting the update at face value can trap you in another cycle of uncertainty if the root problem hasn’t been solved.

Start with verification. Ask for specific status proof—photos of parts or material on the machine, an updated production schedule, and any new shipment target. If the response lacks data or relies on vague reassurance (“We’re catching up, don’t worry”), treat it as a holding tactic, not recovery progress.

Next, evaluate whether continuing is worth the risk. If the delay already exceeded seven days and no physical progress is shown, switching suppliers may still save time overall. Each week of resumed production under unstable workflow can add hidden inspection and freight costs later.

Reliable suppliers welcome accountability—they’ll share timestamped updates and confirm the new lead time in writing. Those who hesitate or give shifting answers usually remain at capacity risk.

Procurement Tip:

When a silent supplier reappears, re-baseline communication before confirming continuation. Request photos, updated lead time, and inspection checkpoints in writing within 24 hours. If they can’t provide these promptly, treat the job as still uncommitted and proceed with your backup quote to secure production continuity.

Conclusion

Supplier silence after a PO usually signals lost control—not lost email. When deadlines slip, you need a partner that communicates, not disappears. Okdor specializes in rescuing stalled CNC projects with verified capacity and milestone visibility. Upload your rejected or delayed drawings now for assessment and a confirmed quote within 24 hours.

Frequently Asked Questions

Sometimes—but treat it as an Engineering Change. Suppliers should review impact, update revisions, and, if form/fit/function or NC programs change, perform a (partial) First Article before resuming. Small CAM tweaks may be quick; specification changes need formal control to protect compliance, traceability, and quality.

Quotes diverge with tolerance targets, surface finishes, setups, machine type, and quantity. Tighter tolerances and extra setups raise cycle time, scrap risk, and metrology cost—sometimes dramatically. Align specs (tolerance bands, finish, quantity) across vendors to compare like-for-like.

Re-baseline now: request factual status and launch a parallel quote. Instant-quote platforms can return pricing and lead times within hours when CAD and drawings are complete, giving you a viable recovery path while you assess the original order’s risk.

Look for process control, not promises. Ask for milestone-based schedules (material, setup, FAI/first-article, shipment) and how changes are controlled under their QMS. Mature ISO-based systems force visible planning and change control—key signals that timelines won’t vanish under pressure.

Yes—if no proprietary tooling is consumed and data transfers cleanly (drawings, models, inspection notes). Expect a brief re-qualification step (often a first-article/partial first-article when processes or NC programs change) before continuing production to your spec. This ensures traceability and conformity after the handover.

Often the issue is tolerance stack-ups, workholding, or inspection—not impossibility. Start by relaxing non-critical tolerances, simplifying setups, and confirming finish specs; many “rejections” clear after DFM review and standardized tolerances. A second opinion with clear tolerances and stock models typically unlocks a path.